200 MOVING AVERAGE ALL STRATEGIES AT A GLANCE

Hello Friends……

Last few months we have published eight series of 200 Moving Average Strategy. For

you are easy to understand and apply, earnmoneyfx.com team presents all of 200

Moving Average Strategy summaries here.

Let’s start….

200 Moving Average Strategy. (Part -1)

Here we have discussed how entry and exit when combo with 200 Moving Average

and Support Resistance. The below link is for your detailed understanding.

200 Moving Average Strategy. (Part -1) Click here

Summery is below here……

IMAGE 1:

200 Moving Average and Support Resistance Entry-Exit Strategy (BUY)

At first, we have a focus on the 200 moving average curves. Are candlesticks cross 200

moving average?

If yes, then we have to identify the key support levels.

Thereafter waiting for candlesticks retest key support level.

If yes, then try to identify which type of candlesticks pattern is. Is it a price action

candlesticks pattern? e.g. (PIN BAR, BULLISH ENGULFING, MORNING STAR,

HAMMER, HARAMI, PIERCING, DOJI).

If yes anyone, we put our buy stop 2 pips above of the price action candlesticks

pattern high.

After hit buy stop order, we place our stop loss 2 pips below of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

IMAGE 2:

200 Moving Average and Support Resistance Entry-Exit Strategy (SELL)

At first, we have a focus on the 200 moving average curves. Are candlesticks cross 200

moving average?

If yes, then we have to identify the key resistance levels.

Thereafter waiting for candlesticks retest key resistance level.

If yes, then try to identify which type of candlesticks pattern is. Is it a price action

candlesticks pattern? e.g. (PIN BAR, BEARISH ENGULFING, SHOOTING STAR, HARAMI,

DARK CLOUD COVER, DOJI).

If yes anyone, we put our sell stop 2 pips below of the price action candlesticks

pattern low.

After hit sell stop order, we place our stop loss 2 pips above of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

200 Moving Average Strategy. (Part- 2)

Here we have discussed how entry and exit 200 Moving Average bounce strategy. The

The below link is for your detailed understanding.

200 Moving Average Strategy. (Part- 2) Click here

Summery is below here……

IMAGE 3:

200 Moving Average retest, Support Resistance and Price action

candlesticks pattern Entry-Exit Strategy (BUY)

At first, we have a focus on the 200 moving average curve. Are candlesticks cross 200

moving average?

If yes, then we have to identify the key support levels.

Thereafter waiting for candlesticks retest 200 moving average and key support level.

If yes, then try to identify which type of candlesticks pattern is. Is it a price action

candlesticks pattern? e.g. (PIN BAR, BULLISH ENGULFING, MORNING STAR,

HAMMER, HARAMI, PIERCING, DOJI).

If yes anyone, we put our buy stop 2 pips above of the price action candlesticks

pattern high.

After hit buy stop order, we place our stop loss 2 pips below of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

IMAGE 4:

200 Moving Average retest, Support Resistance and Price action

candlesticks pattern Entry-Exit Strategy (SELL)

At first, we have a focus on the 200 moving average curves. Are candlesticks cross 200

moving average?

If yes, then we have to identify the key resistance levels.

Thereafter waiting for candlesticks retest 200 moving average and key resistance

level.

If yes, then try to identify which type of candlesticks pattern is. Is it a price action

candlesticks pattern? e.g. (PIN BAR, BEARISH ENGULFING, SHOOTING STAR, HARAMI,

DARK CLOUD COVER, DOJI).

If yes anyone, we put our sell stop 2 pips below of the price action candlesticks

pattern low.

After hit sell stop order, we place our stop loss 2 pips above of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

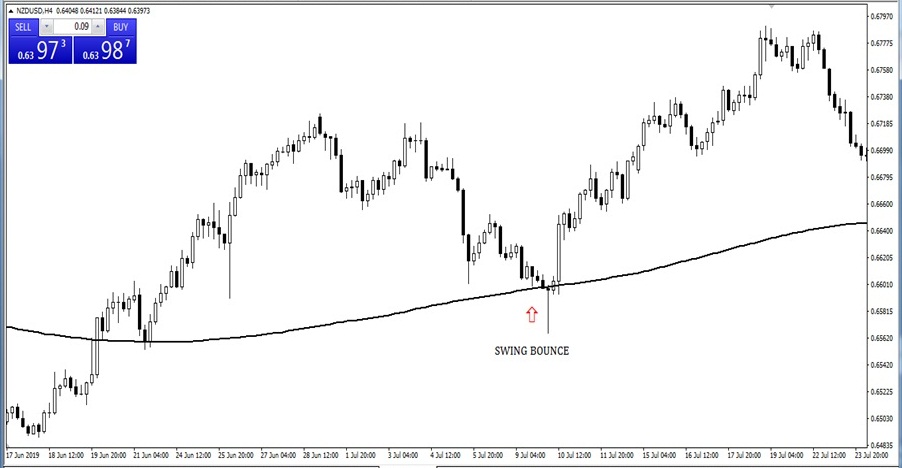

IMAGE 5:

200 Moving Average Swing Bounce Entry-Exit Strategy (BUY)

At first, we have a focus on the 200 moving average curve. Are candlesticks cross 200

moving average?

A few times candlesticks create long-distance after crossed 200 moving average

without any immediate retest. This time we have nothing to do until candlesticks

create swing bounce.

If yes, then try to identify which type of candlesticks pattern is swing zone. Is it a price

action candlesticks pattern? e.g. (PIN BAR, BULLISH ENGULFING, MORNING STAR,

HAMMER, HARAMI, PIERCING, DOJI).

If yes anyone, we put our buy stop 2 pips above of the price action candlesticks

pattern high.

After hit buy stop order, we place our stop loss 2 pips below of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

IMAGE 6:

200 Moving Average Swing Bounce Entry-Exit Strategy (SELL)

At first, we have a focus on the 200 moving average curves. Are candlesticks cross 200

moving average?

A few times candlesticks create long-distance after crossed 200 moving average

without any immediate retest. This time we have nothing to do until candlesticks

create swing bounce.

If yes, then try to identify which type of candlesticks pattern is swing zone. Is it a price

action candlesticks pattern? e.g. (PIN BAR, BEARISH ENGULFING, SHOOTING STAR,

HARAMI, DARK CLOUD COVER, DOJI).

If yes anyone, we put our sell stop 2 pips below of the price action candlesticks

pattern low.

After hit sell stop order, we place our stop loss 2 pips above of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

IMAGE 7:

200 Moving Average Swing Bounce, Support Resistance and Price

action candlesticks pattern Entry-Exit Strategy (BUY)

At first, we have a focus on the 200 moving average curves. Are candlesticks cross 200

moving average?

If yes, then we have to identify the key support levels.

A few times candlesticks create long-distance after crossed 200 moving average

without any immediate retest. This time we have nothing to do until candlesticks

create swing bounce

Thereafter waiting for candlesticks retest 200 moving average and key support level.

If yes, then try to identify which type of candlesticks pattern is. Is it a price action

candlesticks pattern? e.g. (PIN BAR, BULLISH ENGULFING, MORNING STAR,

HAMMER, HARAMI, PIERCING, DOJI).

If yes anyone, we put our buy stop 2 pips above of the price action candlesticks

pattern high.

After hit buy stop order, we place our stop loss 2 pips below of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

IMAGE 8:

200 Moving Average Swing Bounce, Support Resistance and Price

action candlesticks pattern Entry-Exit Strategy (SELL)

At first, we have a focus on the 200 moving average curves. Are candlesticks cross 200

moving average?

If yes, then we have to identify the key resistance levels.

A few times candlesticks create long-distance after crossed 200 moving average

without any immediate retest. This time we have nothing to do until candlesticks

create swing bounce

Thereafter waiting for candlesticks retest 200 moving average and key resistance

level.

If yes, then try to identify which type of candlesticks pattern is. Is it a price action

candlesticks pattern? e.g. (PIN BAR, BEARISH ENGULFING, SHOOTING STAR, HARAMI,

DARK CLOUD COVER, DOJI).

If yes anyone, we put our sell stop 2 pips below of the price action candlesticks

pattern low.

After hit sell stop order, we place our stop loss 2 pips above of price action

candlesticks pattern.

Also set take profit level near swing high or 1:2 or 1:3 of risk reward-ratio whatever

you like.

200 Moving Average Strategy. (Part- 3)

Here we have discussed how entry and exit 200 Moving Average with trend line. The

The below link is for your detailed understanding.

200 Moving Average Strategy. (Part- 3) Click here

Summery is below here……

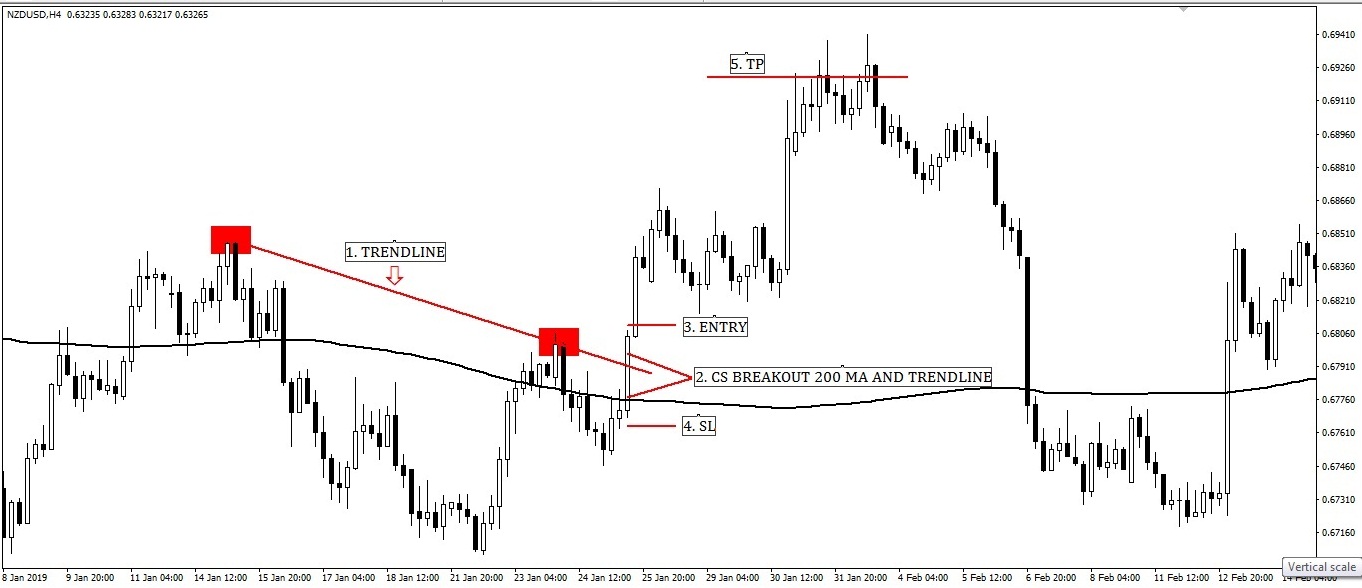

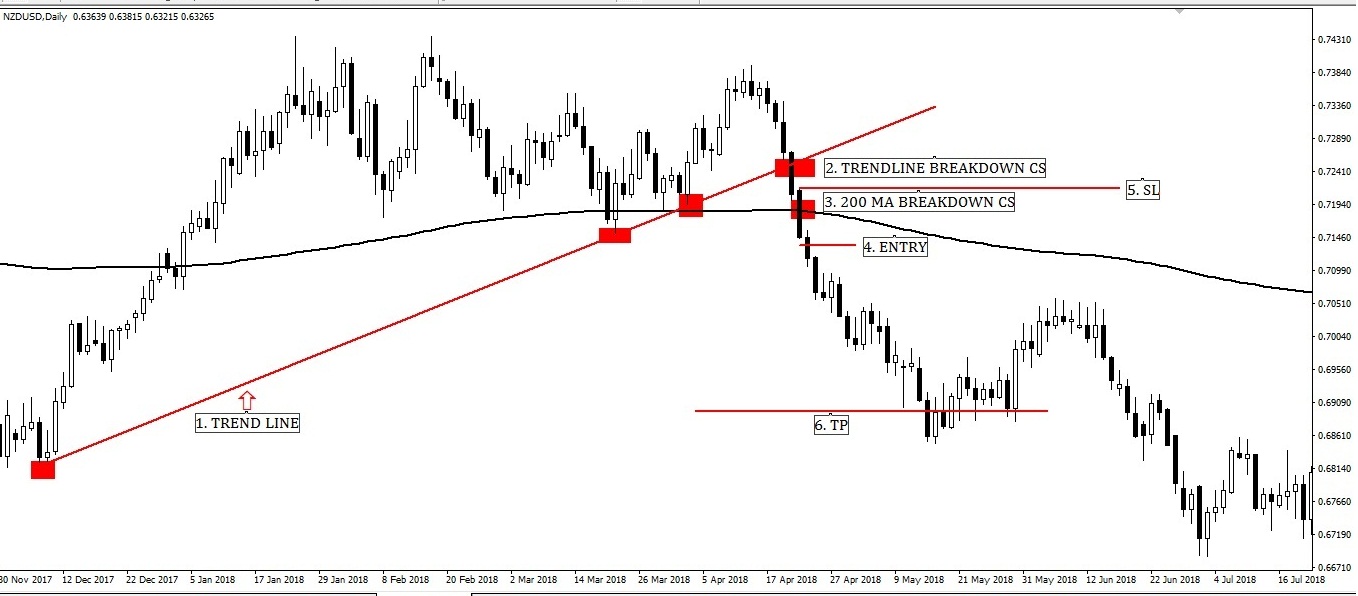

IMAGE 9:

200 Moving Average with Trend Line Breakout Entry-Exit Strategy (BUY)

Image point number – 1, Price going strongly down with few swings. Connecting

two or more swing high, we complete drawing the trend line.

Image point number – 2, 200 Moving Average and Trend line both are the same time

breakout by candlesticks. It’s our signal candle for buy as per this rule.

Image point number – 3, Place BUY STOP order 2 pips above of 200 Moving Average

and Trend line break out candlesticks by the aggressive or conservative trader.

Image point number – 4, Put STOP-LOSS order by aggressive or conservative trader

2 pips below of 200 Moving Average and trend line breakout candlesticks after hit

BUY STOP order. Some most conservative traders place STOP LOSS 2 pips below of

200 Moving Average.

Image point number – 5, Put take profit level on the near swing high or 1: 2 or 1 : 3 risk-

reward ratio by the conservative or aggressive trader.

IMAGE 10:

200 Moving Average with Trend Line Breakout Entry-Exit Strategy (SELL)

Image point number – 1, Price going strongly down with few swings.

Image point number – 2, Trend line breaks down by candlesticks. But don’t hurry to

enter here. 200 Moving Average is our main focus. Sale above 200 Moving Average

will be great foolishness. So its time to wait for candlesticks breaks down 200 Moving

Average.

Image point number – 3, 200 Moving Average breakouts by candlesticks. It’s our

signal candle for buy as per this rule.

Image point number – 4, Place SELL STOP order 2 pips above of 200 Moving

Average and Trend line break out candlesticks by the aggressive or conservative

trader.

Image point number – 5, Put STOP-LOSS order by aggressive or conservative trader

2 pips above of 200 Moving Average breakout candlesticks after hit BUY STOP order.

Some most conservative traders place STOP LOSS 2 pips above 200 Moving Average.

Image point number – 6, Put take profit level on the near swing low or 1: 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

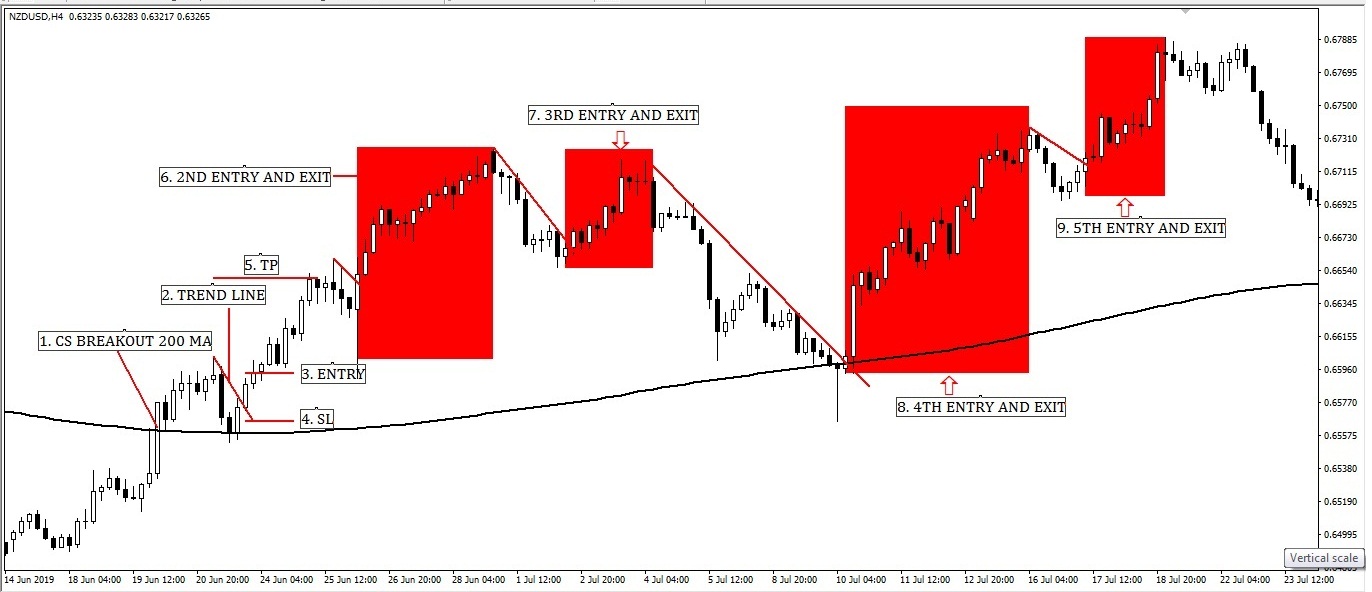

Image 11:

200 Moving Average and Trend Line Breakout Swing Entry-Exit Strategy (BUY)

Image point number – 1, 200 Moving Average breakouts by Candlesticks. No need

enter hurry until candlesticks breakout trend line.

Image point number – 2, Connecting two or more swing high, we complete drawing

trend line.

Image point number – 3, Place BUY STOP order 2 pips above Trend line break out

candlesticks by the aggressive or conservative trader.

Image point number – 4, Put STOP-LOSS order by aggressive or conservative trader

2 pips below trend line breakout candlesticks after hit BUY STOP order.

Image point number – 5, Put take profit level on the near swing high or 1 : 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image point number – 6, 7, 8, and 9, There are more and more entry and exit scope

as per rules.

Image 12:

200 Moving Average and Trend Line Break Down Swing Entry-Exit Strategy (SELL)

Image point number – 1, 200 Moving Average breakouts by Candlesticks. No need

enter hurry until candlesticks breakout trend line.

Image point number – 2, Connecting two or more swing low, we complete drawing

trend line.

Image point number – 3, Place SELL STOP order 2 pips below Trend line break out

candlesticks by the aggressive or conservative trader.

Image point number – 4, Put STOP-LOSS order by aggressive or conservative trader

2 pips above trend line breakout candlesticks after hit BUY STOP order.

Image point number – 5, Put take profit level on the near swing low or 1 : 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image point number – 6, 7, and 8, There are more and more entry and exit scope as

per rules.

200 Moving Average Strategy. (Part- 4)

Here we have discussed how entry and exit 200 Moving Average with Triangle

Pattern. The below link is for your detailed understanding.

200 Moving Average Strategy. (Part- 4) Click here

Summery is below here……

Image 13:

200 Moving Average and Ascending Triangle combo Entry-Exit Strategy

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Already create a few higher-high which means the price is

strong uptrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to correction. Already touches three times in previous high but failure to

breakout.

Image point number – 4, Also the price created three higher low. That chart clearly

indicates its ascending triangle. As per rules, we have to wait for the breakout.

Image point number – 5, Place BUY STOP order 2 pips above ascending triangle

break out candlesticks by the aggressive or conservative trader.

Image point number – 6, Put STOP-LOSS order by aggressive or conservative trader

2 pips below ascending triangle breakout candlesticks after hit BUY STOP order.

Where STOP LOSS place 2 pips below of ascending triangle lower channel by

conservative traders.

Image point number – 7, Lets measure take profit range as per ascending triangle

exit rules.

Image point number – 8, Put take profit level on ascending triangle take profit range

or near swing high or 1: 2 or 1 : 3 risk-reward ratio by the conservative or aggressive

trader.

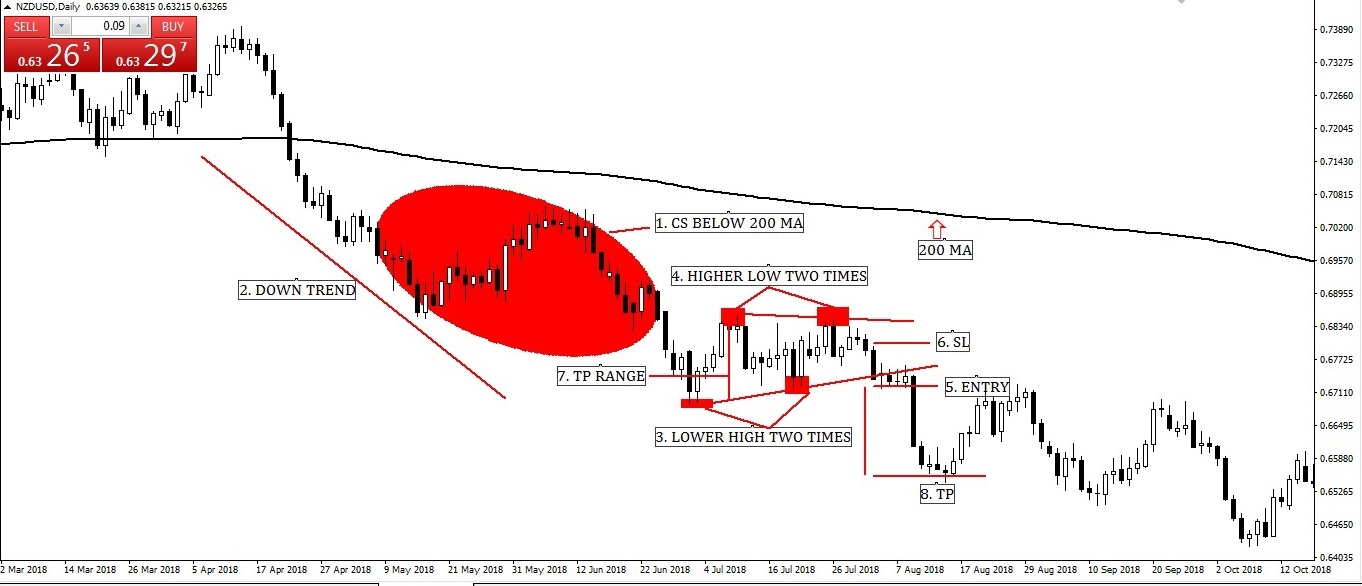

Image 14:

200 Moving Average and Descending Triangle combo Entry-Exit Strategy

Image point number – 1, Candlesticks are below 200 Moving Average which means

its downtrend.

Image point number – 2, Already create a few lower low which means the price is

strong downtrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to reversal. Already touches two times in previous low but failure to breakout.

Image point number – 4, Also the price created four times lower high. That chart

clearly indicates its descending triangle. As per rules, we have to wait for the breakout.

Image point number – 5, Place SELL STOP order 2 pips below descending triangle

break out candlesticks by the aggressive or conservative trader.

Image point number – 6, Put STOP-LOSS order by aggressive or conservative trader

2 pips above descending triangle breakout candlesticks after hit SELL STOP order.

Where STOP LOSS place 2 pips above of descending triangle lower channel by

conservative traders.

Image point number – 7, Lets measure take profit range as per descending triangle

exit rules.

Image point number – 8, Put take profit level on descending triangle take profit

range or near swing high or 1: 2 or 1 : 3 risk-reward ratio by the conservative or

aggressive trader.

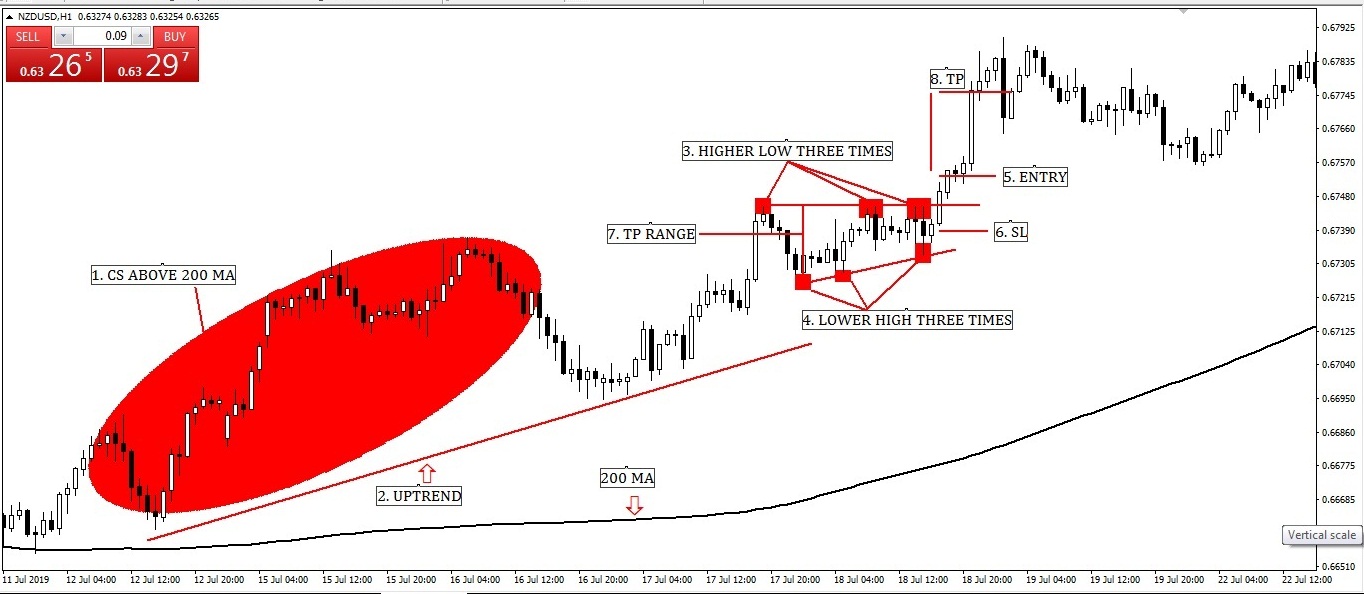

Image 15:

200 Moving Average and Symmetrical Triangle combo Entry-Exit Strategy. (BUY)

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Already create a few higher-high which means the price is

strong uptrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to correction. Already touches three times higher low which means its

indecision.

Image point number – 4, Also the price created three lower high which means the trend

is a pause now. That chart clearly indicates its symmetrical triangle. As per rules, we

have to wait for the breakout.

Image point number – 5, Place BUY STOP order 2 pips above the symmetrical triangle

break out candlesticks by the aggressive or conservative trader.

Image point number – 6, Put STOP-LOSS order by aggressive or conservative trader

2 pips below symmetrical triangle breakout candlesticks after hit BUY STOP order.

Where STOP LOSS place 2 pips below of symmetrical triangle lower channel by

conservative traders.

Image point number – 7, Lets measure take profit range as per symmetrical triangle

exit rules.

Image point number – 8, Put take profit level on symmetrical triangle take profit

range or near swing high or 1: 2 or 1 : 3 risk-reward ratio by the conservative or

aggressive trader.

Image 16:

200 Moving Average and Symmetrical Triangle combo Entry-Exit Strategy. (SELL)

Image point number – 1, Candlesticks are below 200 Moving Average which means

its downtrend.

Image point number – 2, Already create a few lower low which means the price is

strong downtrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to reversal. Already touches two times lower high which means its indecision.

Image point number – 4, Also the price created two times higher low which means

the trend is a pause now. That chart clearly indicates its symmetrical triangle. As per rules,

we have to wait for the breakout.

Image point number – 5, Place SELL STOP order 2 pips below the symmetrical triangle

break out candlesticks by the aggressive or conservative trader.

Image point number – 6, Put STOP-LOSS order by aggressive or conservative trader

2 pips above symmetrical triangle breakout candlesticks after hit SELL STOP order.

Where STOP LOSS place 2 pips above of symmetrical triangle lower channel by

conservative traders.

Image point number – 7, Lets measure take profit range as per symmetrical triangle

exit rules.

Image point number – 8, Put take profit level on symmetrical triangle take profit

range or near swing low or 1: 2 or 1 : 3 risk-reward ratio by the conservative or

aggressive trader.

200 Moving Average Strategy. (Part- 5)

Here we have discussed how entry and exit 200 Moving Average with Flag Pattern

and Channel. The below link is for your detailed understanding.

200 Moving Average Strategy. (Part- 5) Click here

Summery is below here……

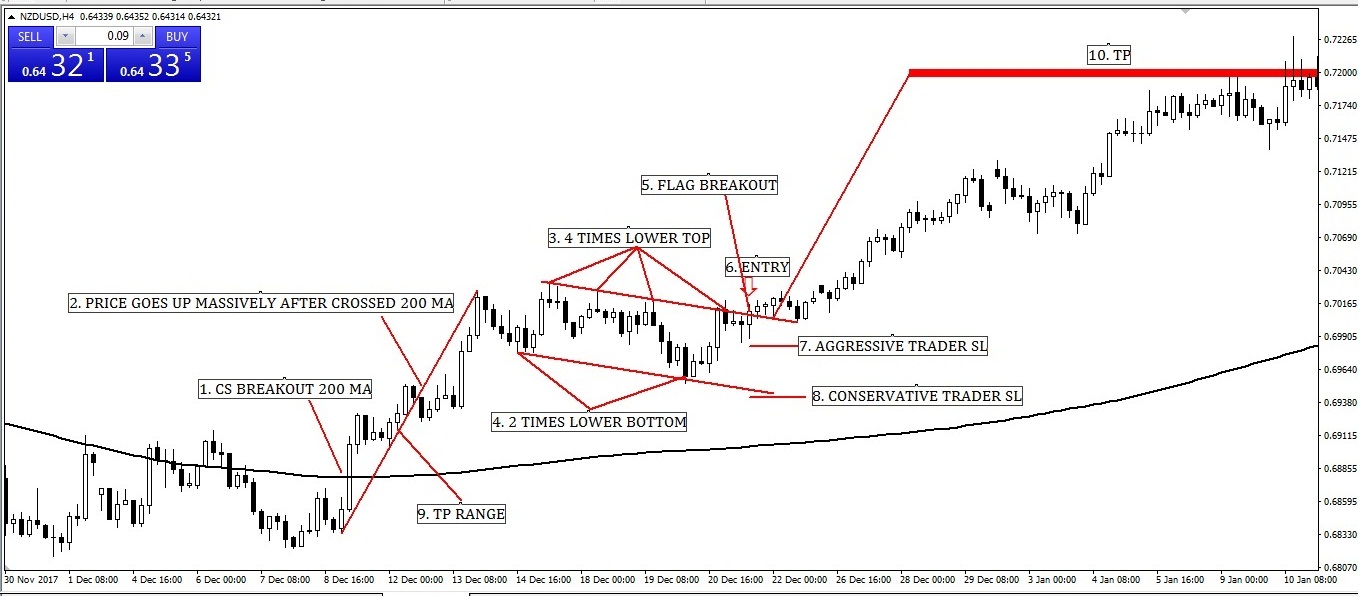

Image 17:

200 Moving Average and Bullish Flag Pattern Entry-Exit Strategy

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Already create a few higher-high which means the price is

strong uptrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to correction. Already create three times lower tops but no breakouts happened.

Image point number – 4, Also the price created two times lower bottom. That chart

indicates its bullish flag pattern. As per rules, we have to wait for the breakout.

Image point number – 5, At last, bullish flag pattern breakouts. As per Bullish Flag

Pattern with 200 Moving Average Entry-Exit Strategy rules its time to buy when

candlesticks close above pattern which indicates a successful breakout.

Image point number – 6, Place BUY STOP order 2 pips above bullish flag pattern

break out candlesticks by the aggressive or conservative trader.

Image point number – 7, Put STOP-LOSS order by aggressive trader 2 pips below

bullish flag pattern breakout candlesticks after hit BUY STOP order.

Image point number – 8, Where STOP LOSS place 2 pips below of bullish flag pattern

lower pattern by conservative traders.

Image point number – 9, Lets measure take profit range as per bullish flag pattern

exit rules.

Image point number – 10, Put take profit level on bullish flag pattern take profit

range or near swing high or 1 : 2 or 1 : 3 risk-reward ratio by the conservative or

aggressive trader.

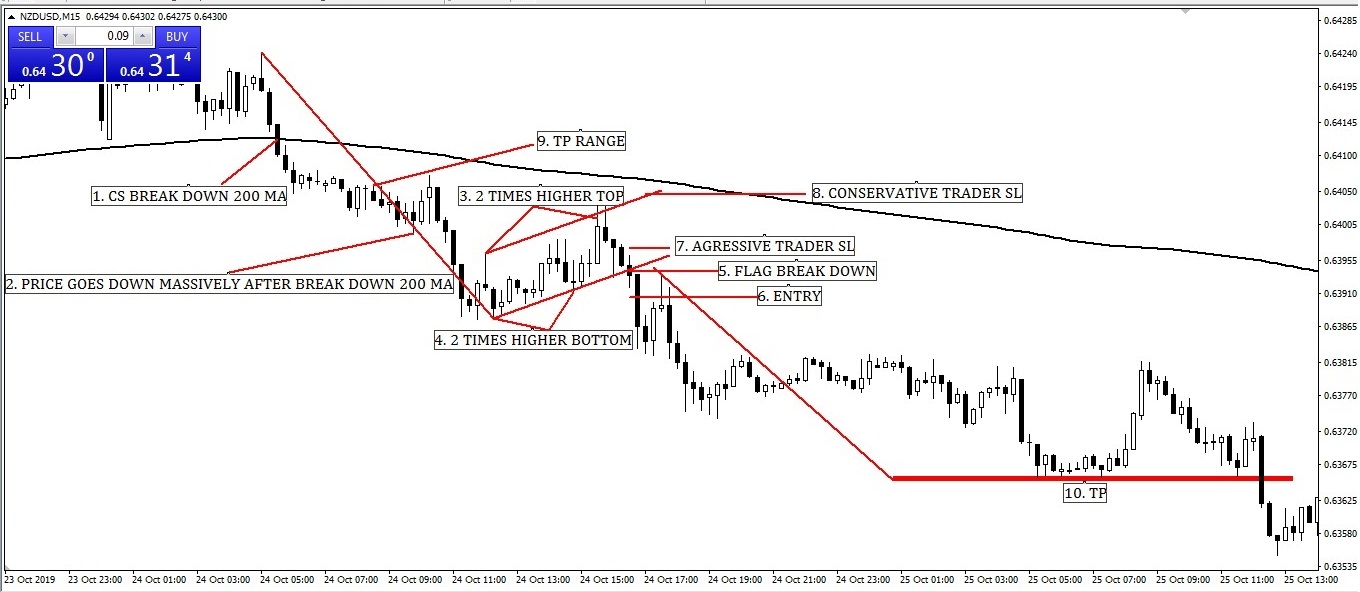

Image 18:

200 Moving Average and Bearish Flag Pattern Entry-Exit Strategy

Image point number – 1, Candlesticks are below 200 Moving Average which means

its downtrend.

Image point number – 2, Already create a few lower low which means the price is

strong uptrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to correction. Already create three times higher tops but no breakouts

happened.

Image point number – 4, Also the price created two times higher bottom. That chart

indicates its bearish flag pattern. As per rules, we have to wait for the breakout.

Image point number – 5, At last, bearish flag pattern breakouts. As per Bearish Flag

Pattern with 200 Moving Average Entry-Exit Strategy rules its time to sell when

candlesticks close below pattern which indicates a successful breakout.

Image point number – 6, Place SELL STOP order 2 pips below bearish flag pattern

break out candlesticks by the aggressive or conservative trader.

Image point number – 7, Put STOP-LOSS order by aggressive trader 2 pips above

bearish flag pattern breakout candlesticks after hit SELL STOP order.

Image point number – 8, Where STOP LOSS place 2 pips above bearish flag pattern

upper pattern by conservative traders.

Image point number – 9, Lets measure take profit range as per bearish flag pattern

exit rules.

Image point number – 10, Put take profit level on bearish flag pattern take profit

range or near swing high or 1: 2 or 1 : 3 risk-reward ratio by the conservative or

aggressive trader.

Image 19:

200 Moving Average and Bullish Channel Pattern Entry-Exit Strategy

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Already create a few higher-high which means the price is

strong uptrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to correction. Already create two times equal tops but no breakouts happened.

Image point number – 4, Also the price created two times equal bottom. That chart

indicates its bullish channel. As per rules, we have to wait for the breakout.

Image point number – 5, At last, bullish channel breakouts. As per the bullish channel

with 200 Moving Average, Entry-Exit Strategy rules its time to buy when candlesticks

close above channel which indicates a successful breakout.

Image point number – 6, Place BUY STOP order 2 pips above bullish channel break

out candlesticks by the aggressive or conservative trader.

Image point number – 7, Put STOP-LOSS order by aggressive trader 2 pips below

bullish channel breakout candlesticks after hit BUY STOP order.

Image point number – 8, Where STOP LOSS place 2 pips below of bullish channel

lower channel by conservative traders.

Image point number – 9, Lets measure take profit range as per bullish channel exit

rules.

Image point number – 10, Put take profit level on bullish channel take profit range

or near swing high or 1: 2 or 1 : 3 risk-reward ratio by the conservative or aggressive

trader.

Image 20:

200 Moving Average and Bearish Flag Channel Entry-Exit Strategy

Image point number – 1, Candlesticks are below 200 Moving Average which means

its downtrend.

Image point number – 2, Already create a few lower low which means the price is

strong downtrend now.

Image point number – 3, Price never up or down straight. As expected price has

gone to correction. Already create two times equal tops but no breakouts happened.

Image point number – 4, Also the price created two times equal bottom. That chart

indicates its bearish channel. As per rules, we have to wait for the breakout.

Image point number – 5, At last, bearish channel breakouts. As per Bearish channel

with 200 Moving Average, Entry-Exit Strategy rules its time to sell when candlesticks

close below channel which indicates a successful breakout.

Image point number – 6, Place SELL STOP order 2 pips below bearish channel break

out candlesticks by the aggressive or conservative trader.

Image point number – 7, Put STOP-LOSS order by aggressive trader 2 pips above

bearish channel breakout candlesticks after hit SELL STOP order.

Image point number – 8, Where STOP LOSS place 2 pips above the bearish channel

upper channel by conservative traders.

Image point number – 9, Lets measure take profit range as per bearish channel exit

rules.

Image point number – 10, Put take profit level on bearish channel take profit range

or near swing high or 1: 2 or 1 : 3 risk-reward ratio by the conservative or aggressive

trader.

200 Moving Average Strategy. (Part- 6)

Here we have discussed how entry and exit 200 Moving Average Golden Cross and

Death Cross. The below link is for your detailed understanding.

200 Moving Average Strategy. (Part- 6) Click here

Summery is below here……

Image 21:

Aggressive Golden Cross Entry-Exit Strategy.

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Candlesticks never close below 200 Simple Moving

Average though we observe sideways movement above 200 Simple Moving Average.

Identified till now bullish trend lets wait for Golden Cross.

After Golden Cross created hope price will go up massively.

Image point number – 3, Place BUY STOP order 2 pips above Golden Crossing

candlesticks by the aggressive or conservative trader.

Image point number – 4, Put STOP-LOSS order by aggressive trader 2 pips below 50

Simple Moving Average after hit BUY STOP order.

Where STOP LOSS place 2 pips below 200 Simple Moving Average by conservative

traders.

Image point number – 5, Put take profit level on the near swing high or 1 : 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image 22:

Golden Cross Traders Action Zone (TAZ) Entry-Exit Strategy.

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Though price goes up massively after the Golden Cross, but

don’t be greedy because we have to wait until the price comes back Traders Action Zone

(TAZ). As a disciplined trader, we must follow Traders Action Zone (TAZ) Entry and

Exit Strategy rules.

Image point number – 3, After come back in Traders Action Zone (TAZ), Now time to

identify bullish price action reversal candlesticks pattern (PIN BAR, BULLISH

ENGULFING, MORNING STAR, HAMMER, HARAMI, PIERCING, DOJI, etc.)

Image point number – 4, Place BUY STOP order 2 pips above Bullish price action

reversal candlesticks in Traders Action Zone (TAZ) area by the aggressive or

conservative trader.

Image point number – 5, Put STOP-LOSS order by aggressive trader 2 pips below

price action reversal candlesticks after hit BUY STOP order.

Where STOP LOSS place 2 pips below 200 Simple Moving Average by conservative

traders.

Image point number – 6, Put take profit level on the near swing high or 1: 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

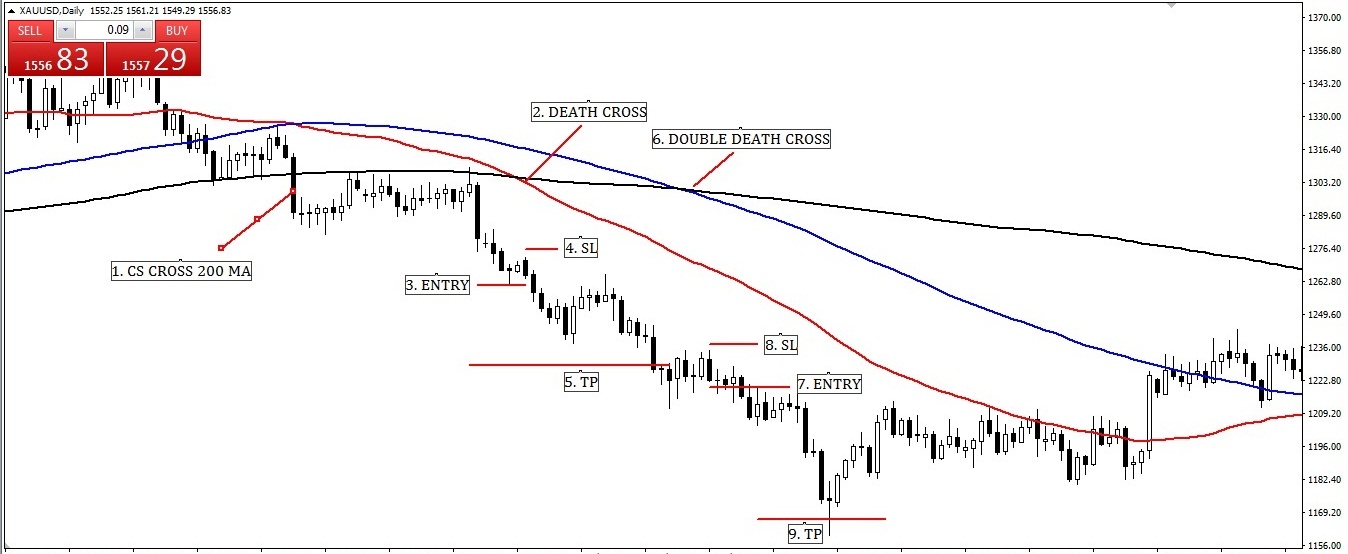

Image 23:

Aggressive Death Cross Entry-Exit Strategy.

Image point number – 1, Candlesticks are below 200 Moving Average which means

its downtrend.

Image point number – 2, Candlesticks never close above 200 Simple Moving Average

though we observe sideways movement above 200 Simple Moving Average. Identified

till now downtrend lets wait for Death Cross.

After Death Cross created hope price will go down massively.

Image point number – 3, Place SELL STOP order 2 pips below Death Crossing

candlesticks by the aggressive or conservative trader.

Image point number – 4, Put STOP-LOSS order by aggressive trader 2 pips above 50

Simple Moving Average after hit the SELL STOP order.

Where STOP LOSS place 2 pips above 200 Simple Moving Average by conservative

traders.

Image point number – 5, Put take profit level on the near swing low or 1: 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image 24:

Death Cross Traders Action Zone (TAZ) Entry-Exit Strategy.

Image point number – 1, Candlesticks are below 200 Moving Average which means

its uptrend.

Image point number – 2, Though price goes down massively after the Death Cross,

but don’t be greedy because we have to wait until the price comes back Traders Action

Zone (TAZ). As a disciplined trader, we must follow the Traders Action Zone (TAZ) Entry

and Exit Strategy rules.

Image point number – 3, After come back in Traders Action Zone (TAZ), Now time to

identify bearish price action reversal candlesticks pattern (PIN BAR, BEARISH

ENGULFING, SHOOTING STAR, HARAMI, DARK CLOUD COVER, DOJI, etc.)

Image point number – 4, Place SELL STOP order 2 pips below Bearish price action

reversal candlesticks in Traders Action Zone (TAZ) area by the aggressive or

conservative trader.

Image point number – 5, Put STOP-LOSS order by aggressive trader 2 pips above

price action reversal candlesticks after hit SELL STOP order.

Where STOP LOSS place 2 pips above 200 Simple Moving Average by conservative

traders.

Image point number – 6, Put take profit level on the near swing low or 1 : 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

200 Moving Average Strategy. (Part- 7)

Here we have discussed how entry and exit 200 Moving Average Double Golden Cross

and Double Death Cross. The below link is for your detailed understanding.

200 Moving Average Strategy. (Part- 7) Click here

Summery is below here……

Image 25:

Aggressive Double Golden Cross Entry-Exit Strategy.

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Candlesticks never close below 200 Simple Moving

Average though we observe sideways movement above 200 Simple Moving Average.

Identified till now bullish trend lets wait for Golden Cross.

After Golden Cross created hope price will go up massively.

Image point number – 3, Place BUY STOP order 2 pips above Golden Crossing

candlesticks by the aggressive or conservative trader.

Image point number – 4, Put STOP-LOSS order by aggressive trader 2 pips below 50

Simple Moving Average after hit BUY STOP order.

Where STOP LOSS place 2 pips below 200 Simple Moving Average by conservative

traders.

Image point number – 5, Put take profit level on the near swing high or 1: 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image point number – 6, After hitting the previous setup take profit, Candlesticks never

close below 200 Simple Moving Average though we observe sideways movement

above 200 Simple Moving Average. Identified till now bullish trend lets wait for

Double Golden Cross.

After Golden Cross created hope price will go up massively.

Image point number – 7, Place BUY STOP order 2 pips above Double Golden

Crossing candlesticks by the aggressive or conservative trader.

Image point number – 8, Put STOP-LOSS order by aggressive trader 2 pips below of

entry candlesticks.

Where STOP LOSS place 2 pips below 50 Simple Moving Average or 100 Simple

Moving Average or 200 Simple Moving Average by conservative traders.

Image point number – 9, Put take profit level on the near swing high or 1: 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image 26:

Double Golden Cross Traders Action Zone (TAZ) Entry-Exit Strategy.

Image point number – 1, Candlesticks are above 200 Moving Average which means

its uptrend.

Image point number – 2, Though price goes up massively after the Golden Cross, but

don’t be greedy because we have to wait until the price comes back Traders Action Zone

(TAZ). As a disciplined trader, we must follow Traders Action Zone (TAZ) Entry and

Exit Strategy rules.

Image point number – 3, Though price goes up massively after the Double Golden

Cross, but don’t be greedy because we have to wait until the price comes back Traders

Action Zone (TAZ). As a disciplined trader, we must follow Traders Action Zone (TAZ)

Entry and Exit Strategy rules.

Image point number – 4, After come back in Traders Action Zone (TAZ), Now time to

identify bullish price action reversal candlesticks pattern (PIN BAR, BULLISH

ENGULFING, MORNING STAR, HAMMER, HARAMI, PIERCING, DOJI, etc.)

Image point number – 5, Place BUY STOP order 2 pips above Bullish price action

reversal candlesticks in Traders Action Zone (TAZ) area by the aggressive or

conservative trader.

Image point number – 6, Put STOP-LOSS order by aggressive trader 2 pips below

price action reversal candlesticks after hit BUY STOP order.

Where STOP LOSS place 2 pips below 200 Simple Moving Average by conservative

traders.

Image point number – 7, Put take profit level on the near swing high or 1: 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image 27:

Aggressive Double Death Cross Entry-Exit Strategy.

Image point number – 1, Candlesticks are below 200 Moving Average which means

its downtrend.

Image point number – 2, Candlesticks never close above 200 Simple Moving Average

though we observe sideways movement above 200 Simple Moving Average. Identified

till now bearish trend lets wait for Death Cross.

After Death Cross created hope price will go down massively.

Image point number – 3, Place SELL STOP order 2 pips above Death Crossing

candlesticks by the aggressive or conservative trader.

Image point number – 4, Put STOP-LOSS order by aggressive trader 2 pips above 50

Simple Moving Average after hit the SELL STOP order.

Where STOP LOSS place 2 pips above 200 Simple Moving Average by conservative

traders.

Image point number – 5, Put take profit level on the near swing low or 1: 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image point number – 6, After hitting the previous setup take profit, Candlesticks never

close above 200 Simple Moving Average though we observe sideways movement

above 200 Simple Moving Average. Identified till now bearish trend lets wait for

Double Death Cross.

After Death Death Cross created hope price will go down massively.

Image point number – 7, Place SELL STOP order 2 pips below Double Death Crossing

candlesticks by the aggressive or conservative trader.

Image point number – 8, Put STOP-LOSS order by aggressive trader 2 pips above of

entry candlesticks.

Where STOP LOSS place 2 pips above 50 Simple Moving Average or 100 Simple

Moving Average or 200 Simple Moving Average by conservative traders.

Image point number – 9, Put take profit level on the near swing low or 1 : 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

Image 28:

Double Death Cross Traders Action Zone (TAZ) Entry-Exit Strategy.

Image point number – 1, Candlesticks are above 200 Moving Average which means

its downtrend.

Image point number – 2, Though price goes down massively after the Death Cross,

but don’t be greedy because we have to wait until the price comes back Traders Action

Zone (TAZ). As a disciplined trader, we must follow the Traders Action Zone (TAZ) Entry

and Exit Strategy rules.

Image point number – 3, Also Though price goes up massively after the Double

Death Cross, but don’t be greedy because we have to wait until the price comes back

Traders Action Zone (TAZ). As a disciplined trader, we must follow Traders Action

Zone (TAZ) Entry and Exit Strategy rules.

Image point number – 4, After come back in Traders Action Zone (TAZ), Now time to

identify bearish price action reversal candlesticks pattern (PIN BAR, BEARISH

ENGULFING, SHOOTING STAR, HARAMI, K CLOUD COVER, DOJI, etc.)

Image point number – 5, Place SELL STOP order 2 pips above Bearish price action

reversal candlesticks in Traders Action Zone (TAZ) area by the aggressive or

conservative trader.

Image point number – 6, Put STOP-LOSS order by aggressive trader 2 pips above

price action reversal candlesticks after hit the SELL STOP order.

Where STOP LOSS place 2 pips above 200 Simple Moving Average by conservative

traders.

Image point number – 7, Put take profit level on the near swing low or 1 : 2 or 1 : 3

the risk-reward ratio by the conservative or aggressive trader.

200 Moving Average Strategy. (Part- 8)

Here we have discussed how entry and exit 200 Moving Average with the multi time

frame. The below link is for your detailed understanding.

Summery is below here……

200 Moving Average Strategy. (Part- 8) Click here

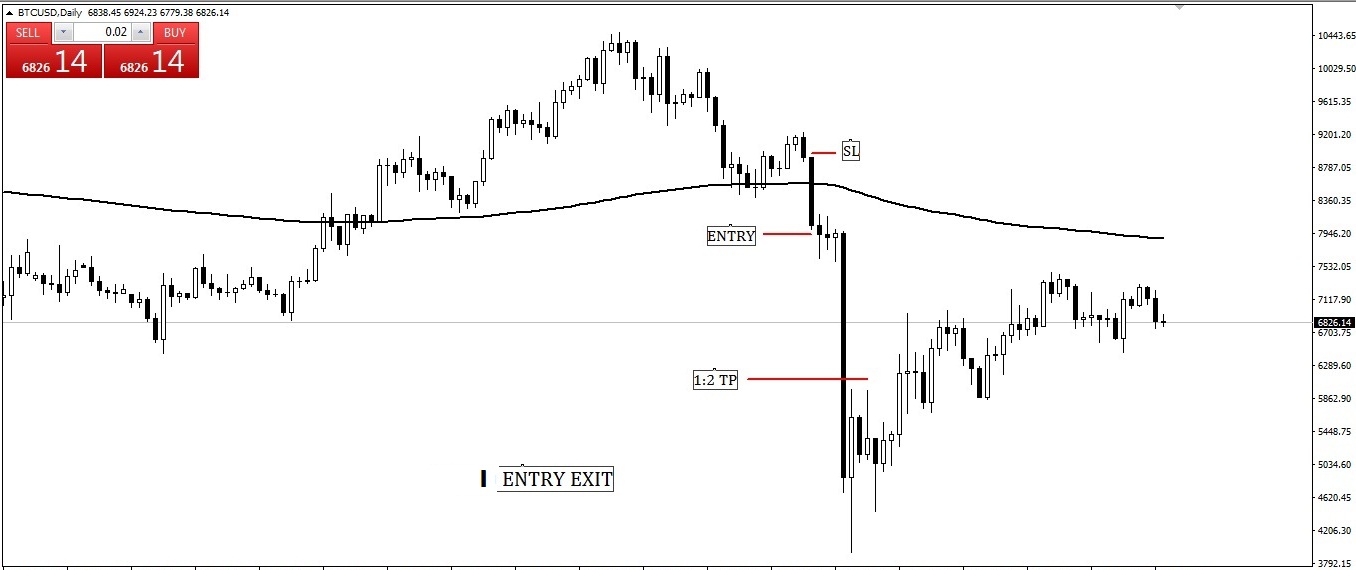

IMAGE 29:

X ENTRY

After daily Bearish Engulfing candlesticks close below 200 Moving Average of

BITCOIN, X enter here below 5 pips. Stop Loss set 5 pips above of Bearish

Engulfing candlesticks. Also, take profit level ser 1:2 or Swing Low. Here swing low

measured 1:1.7 thereafter X determined to set take profit level at 1:2.

WAOOOOO……Take profit hit.

X feeling excellent that his trade hit 1:2

IMAGE 30:

Y ENTRY

After hourly Bearish Engulfing candlesticks close below 200 Moving Average of

BITCOIN, Y enter here below 5 pips. Stop Loss set 5 pips above of Bearish

Engulfing candlesticks.

Before entry hourly Bearish Engulfing candlesticks Y watched Daily chart and

understand that BITCOIN will cross daily 200 Moving Average immediately. At a time

Y switched to hourly chart and keep focus till candlesticks cross 200 hourly

Moving Average. Here daily swing low is 1:17 and Y set take profit level on

the swing low. WAOOOOO……Take profit hit.

Y feeling excellent that his trade hit 1:17

Its the power of MULTI TIME FRAME analysis……… were applied for same entry and

exit strategy Y earns more than 15 times of X

Below simple technique for you when using multi-timeframe analysis…..

When you are day trader, First Identify trend on H1 then entry on M15.

When If you are swing trader, First Identify trend on D1 then entry on H1.

When If you are position trader, First Identify trend on W1 then entry on D1.

D1 mean Daily Candlesticks, H1 means One Hour Candlesticks, M15 means 15 Minute

candlesticks and W1 means weekly candlesticks.

200 Moving Average with Multi time frame Entry-Exit Strategy:

When you trade Multi time frame 200 Moving Average Buy Entry-Exit Strategy

(as a Swing Trader) you must have followed below rules:

Rules 1: Observe Candlesticks’ position. When candlesticks cross daily 200 Moving

Average from below at a time switched one hour chart.

Rules 2: Observe one-hour candlesticks pattern and try to find out is it cross 200

Moving Average. Try to identify candlesticks pattern if it crosses 200 Moving Average.

The best candlesticks pattern is Engulfing, Doji and Inside bar when 200 Moving

Average crossing or retest.

Rules 3: Put Buy Stop two to five pips above of identified candlesticks. Also, put stop

loss two to five pips below of identified candlesticks. And put profit level on the daily

swing high or 1:2, 1:3 risk-reward ratio on the daily time frame.

When you trade Multi time frame 200 Moving Average Sell Entry-Exit Strategy

(as a Swing Trader) you must have followed below rules:

Rules 1: Observe Candlesticks’ position. When candlesticks cross daily 200 Moving

Average from above at a time switched one hour chart.

Rules 2: Observe one-hour candlesticks pattern and try to find out is it crosses 200

Moving Average. Try to identify candlesticks pattern if it crosses 200 Moving Average.

The best candlesticks pattern is Engulfing, Doji and Inside bar when 200 Moving

Average crossing or retest.

Rules 3: Put Sell Stop two to five pips below of identified candlesticks. Also, put stop

loss two to five pips above of identified candlesticks. And put profit level on the daily

swing low or 1:2, 1:3 risk-reward ratio on the daily time frame.

When you trade Multi time frame 200 Moving Average Buy Entry-Exit Strategy

(as a day Trader) you must have followed below rules:

Rules 1: Observe Candlesticks’ position. When candlesticks cross hourly 200 Moving

Average from below at a time switched Fifteen Minute chart.

Rules 2: Observe Fifteen Minute candlesticks pattern and try to find out is it cross 200

Moving Average. Try to identify candlesticks pattern if it cross 200 Moving Average.

The best candlesticks pattern is Engulfing, Doji and Inside bar when 200 Moving

Average crossing or retest.

Rules 3: Put Buy Stop two to five pips above of identified candlesticks. Also, put stop

loss two to five pips below of identified candlesticks. And put profit level on the daily

swing high or 1:2, 1:3 risk-reward ratio on the daily time frame.

When you trade Multi time frame 200 Moving Average Sell Entry-Exit Strategy

(as a Day Trader) you must have followed below rules:

Rules 1: Observe Candlesticks’ position. When candlesticks cross hourly 200 Moving

Average from above at a time switched Fifteen Minute chart.

Rules 2: Observe Fifteen Minute candlesticks pattern and try to find out is it crosses

200 Moving Average. Try to identify candlesticks pattern if it crosses 200 Moving

Average. The best candlesticks pattern is Engulfing, Doji and Inside bar when 200

Moving Average crossing or retest.

Rules 3: Put Sell Stop two to five pips below of identified candlesticks. Also, put stop

loss two to five pips above of identified candlesticks. And put profit level on the daily

swing low or 1:2, 1:3 risk-reward ratio on the daily time frame.

When you trade Multi time frame 200 Moving Average Buy Entry-Exit Strategy

(as a Position Trader) you must have followed below rules:

Rules 1: Observe Candlesticks’ position. When candlesticks cross Weekly 200 Moving

Average from below at a time switched Daily chart.

Rules 2: Observe Daily candlesticks pattern and try to find out is it cross 200 Moving

Average. Try to identify candlesticks pattern if it crosses 200 Moving Average. The best

candlesticks pattern is Engulfing, Doji, and Inside bar when 200 Moving Average

crossing or retest.

Rules 3: Put Buy Stop two to five pips above of identified candlesticks. Also, put stop

loss two to five pips below of identified candlesticks. And put profit level on the daily

swing high or 1:2, 1:3 risk-reward ratio on the daily time frame.

When you trade Multi time frame 200 Moving Average Sell Entry-Exit Strategy

(as a Position Trader) you must have followed below rules:

Rules 1: Observe Candlesticks’ position. When candlesticks cross Weekly 200 Moving

Average from above at a time switched Daily chart.

Rules 2: Observe Dailycandlesticks pattern and try to find out is it crosses 200 Moving

Average. Try to identify candlesticks pattern if it crosses 200 Moving Average. The best

candlesticks pattern is Engulfing, Doji, and Inside bar when 200 Moving Average

crossing or retest.

Rules 3: Put Sell Stop two to five pips below of identified candlesticks. Also, put stop

loss two to five pips above of identified candlesticks. And put profit level on the daily

swing low or 1:2, 1:3 risk-reward ratio on the daily time frame.

WAOO….. IT’S NEAR SEVEN THOUSAND CONTENT ARTICLE. SO IT WILL

TAKE YOUR VALUABLE TIME. KEEP PATIENCE. REMEMBER, TODAY HARD

WORKING WILL CREATE YOU A CONSISTENTLY PROFITABLE FOREX,

STOCK, COMMODITY, AND OPTION TRADER. THERE IS NO SHORTCUT

HERE. IF YOU TRY TO KNOW ABOUT SUCCESSFUL FOREX, STOCK,

COMMODITY AND OPTION TRADER IN THE WORLD, YOU MUST FIND ONE

SIMILARITY OF ALL. THIS SIMILARITY IS HARD WORKING AND DESIRE TO

BE SUCCESSFUL.

Special suggestion from the earnmoneyfx.com team…….

If you are a beginner trader, try to adopt one or two strategies from here.

If you are advanced trader, try to adopt one by one strategy from here.

If you are an expert trader, try to adopt all strategies from here.

Thanks for giving your most valuable time and keep touch earnmoneyfx.com also

leave your valuable comment.

Earnmoneyfx.com team will present here new series articles for you.

~~~~~~~~~~~~~~~~~~~~ THANKS ~~~~~~~~~~~~~~~~~~~~~

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience