Awesome Oscillator with Relative Strength Index Combo Forex Strategy There is many types of traders in the forex market. E.g. Position Trader, Breakout

Trader, Pullback Trader, Swing Trader, Momentum Trader, and Novish Trader

etc.

If you are Momentum Trader this Awesome Oscillator with Relative Strength

Index (RSI) Combo Forex Strategy is for you. It will help you to catch and ride

Momentum properly.

Before exploring this Awesome Oscillator with Relative Strength Index (RSI)

Combo Forex Strategy at first we have to know details of Awesome Oscillator

and Relative Strength Index (RSI)

What is an Awesome Oscillator?

Bill Williams developed an Awesome Oscillator.

Awesome Oscillator usage was to measure the momentum in the Forex

market (or any market) by using a combination of:

34 period simple moving average of the median of the previous 34

candlesticks

5 period simple moving average of the median of the previous 5 candlesticks

Zero lines plus histogram

Calculation:

Awesome Oscillator is a 34-period simple moving average, plotted through

the central points of the bars (H+L)/2, and subtracted from the 5-period

simple moving average graphed across the central points of the bars

(H+L)/2.

MEDIAN PRICE = (HIGH + LOW) / 2

AO = SMA (MEDIAN PRICE, 5) – SMA (MEDIAN PRICE, 34)

Where:

MEDIAN PRICE — median price;

HIGH — the highest price of the bar;

LOW — the lowest price of the bar;

SMA — Simple Moving Average.

Awesome Oscillator with Relative Strength Index Combo Forex Strategy

Identify Trend with Awesome Oscillator:

Uptrend: When Awesome Oscillator is above the zero line that means its

uptrend because as per Awesome Oscillator calculation Median Simple

Moving Average (SMA) 5 crossed Median Simple Moving Average (SMA) 34

from below.

Downtrend: When Awesome Oscillator is below the zero line that means its

downtrend because as per Awesome Oscillator calculation Median Simple

Moving Average (SMA) 5 crossed Median Simple Moving Average (SMA) 34

from above.

When the histogram is rising green, we can determine that the Awesome

Oscillator value of this candlestick if higher than the previous

When the histogram is falling red, the value of the Awesome Oscillator is less

then the previous candlestick

Twin Peak: When Awesome Oscillator is shown divergence then its call twin

peak.

What is the Relative Strenght Index (RSI)?

Relative Strength Index (RSI) developed by J. Welles Wilder. It’s also a momentum

indicator. You can easily catch and ride momentum via Relative Strength Index

(RSI).

RSI oscillates between zero and 100.

According to Wilder, RSI is considered overbought when above 70 and oversold

when below 30.

Signals can also be generated by looking for divergences, failure swings and

centerline crossovers. RSI can also be used to identify the general trend.

Calculation of Relative Strength Index (RSI):

100

RSI = 100 – ——–

1 + RS

RS = Average Gain / Average Loss

The very first calculations for average gain and average loss are simple 14-period

averages:

First Average Gain = Sum of Gains over the past 14 periods / 14.

First Average Loss = Sum of Losses over the past 14 periods / 14

The second, and subsequent, calculations are based on the prior averages and the

current gain loss:

Average Gain = [(previous Average Gain) x 13 + current Gain] / 14.

Average Loss = [(previous Average Loss) x 13 + current Loss] / 14.

Let’s explore Awesome Oscillator with Relative Strength Index (RSI) Combo

Forex Strategy

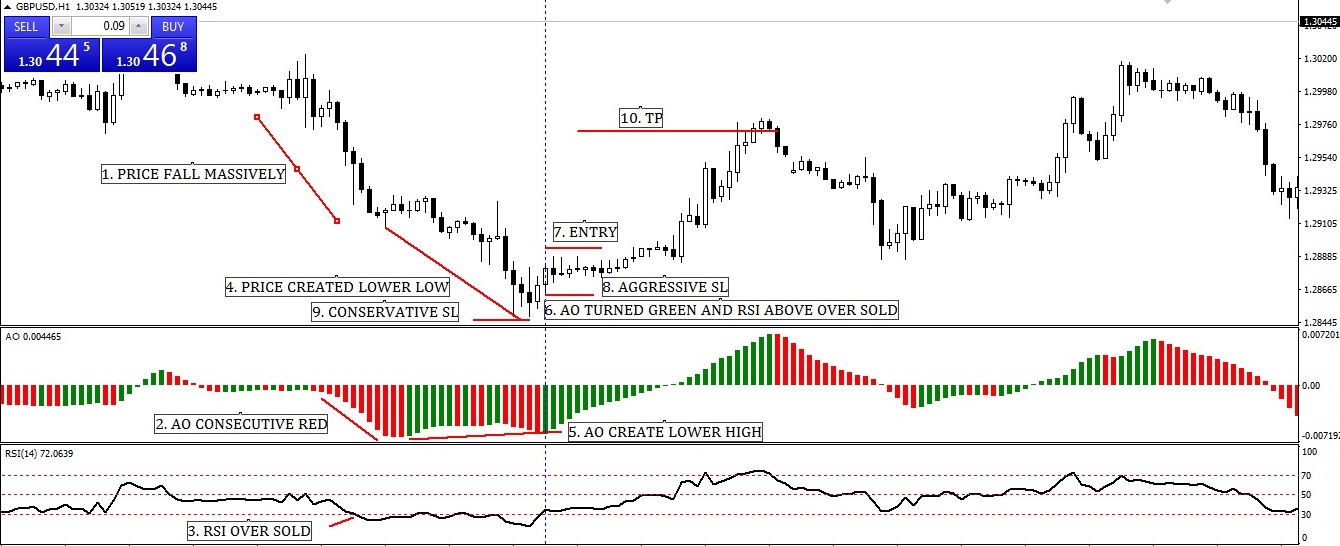

Image 1:

Awesome Oscillator with Relative Strength Index

(RSI) Combo Forex Strategy (BUY)

Image point number – 1, We see the price goes down massively. As per

Awesome Oscillator with Relative Strength Index (RSI) Combo Forex Strategy

(BUY) rules this time we have nothing to do only observe.

Image point number – 2, Awesome Oscillator shown consecutively RED. As

per Awesome Oscillator with Relative Strength Index (RSI) Combo Forex Strategy (BUY) rules this time we have nothing to do only observe. We need

more confirmation.

Image point number – 3, Relative Strength Index (RSI) is in oversold area.

But As per Awesome Oscillator with Relative Strenght Index (RSI) Combo

Forex Strategy (BUY) rules this time we have nothing to do only observe. We

need more confirmation.

Image point number – 4, Price created Lower Low. It’s s a chance to create

divergence if Awesome Oscillator will create Lower High. Lets CHECK…..

Image point number – 5, WOW……. Awesome Oscillator create Lower High.

Its DIVERGENCE. As per Awesome Oscillator with Relative Strength Index

(RSI) Combo Forex Strategy (BUY) rules this time we have to do if Awesome

Oscillator turned GREEN and Relative Strength Index (RSI) above oversold

area same time or within two candlesticks.

Image point number – 6, EXCELLENT…… Awesome Oscillator turned GREEN

and Relative Strength Index (RSI) above oversold area same time.

As per Awesome Oscillator with Relative Strength Index (RSI) Combo Forex

Strategy (BUY) rules, its BUY signal.

Image point number – 7, Aggressive or conservative trader put their BUY

STOP order 2 pips above Awesome Oscillator turned GREEN and Relative

Strength Index (RSI) above the oversold area candlesticks.

Image point number – 8, After hit BUY STOP order aggressive trader place

STOP LOSS 2 pips below of Awesome Oscillator turned GREEN and Relative

Strength Index (RSI) above the oversold area candlesticks.

Image point number – 9, Conservative traders place STOP LOSS 2 pips below

of Swing Low.

Image point number – 10, Conservative or aggressive trader place their take

profit level on near swing High or 1: 2 or 1 : 3 risk-reward ratio.

Image 2:

Awesome Oscillator with Relative Strenght Index (RSI)

Combo Forex Strategy (SELL)

Image point number – 1, We see price goes up massively. As per Awesome

Oscillator with Relative Strength Index (RSI) Combo Forex Strategy (SELL)

rules this time we have nothing to do only observe.

Image point number – 2, Awesome Oscillator shown consecutively GREEN.

As per Awesome Oscillator with Relative Strength Index (RSI) Combo Forex

Strategy (SELL) rules this time we have nothing to do only observe. We need

more confirmation.

Image point number – 3, Relative Strength Index (RSI) are in overbought

area. But As per Awesome Oscillator with Relative Strength Index (RSI)

Combo Forex Strategy (SELL) rules this time we have nothing to do only

observe. We need more confirmation.

Image point number – 4, Price created Higher High. It’s s a chance to create

divergence if Awesome Oscillator will create Higher Low. Let’s CHECK…..

Image point number – 5, WOW……. Awesome Oscillator creates Higher Low.

Its DIVERGENCE. As per Awesome Oscillator with Relative Strength Index

(RSI) Combo Forex Strategy (SELL) rules this time we have to do if Awesome

Oscillator turned RED and Relative Strength Index (RSI) below overbought

area same time or within two candlesticks.

Image point number – 6, EXCELLENT…… Awesome Oscillator turned RED

and Relative Strength Index (RSI) below overbought area same time.

As per Awesome Oscillator with Relative Strength Index (RSI) Combo Forex

Strategy (SELL) rules, its SELL signal.

Image point number – 7, Aggressive or conservative trader put their SELL

STOP order 2 pips above Awesome Oscillator turned RED and Relative

Strength Index (RSI) below overbought area candlesticks.

Image point number – 8, After hit SELL STOP order aggressive trader place

STOP LOSS 2 pips above of Awesome Oscillator turned RED and Relative

Strength Index (RSI) below the overbought area candlesticks.

Image point number – 9, Conservative traders place STOP LOSS 2 pips above

of Swing High.

Image point number – 10, Conservative or aggressive trader place their take

profit level on near swing Low or 1 : 2 or 1 : 3 risk-reward ratio.

Best Forex Swing Trading Strategy With Alligator Indicator CLICK HERE

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience

I was recommended this website by my cousin. I’m not sure whether this

post is written by him as no one else know such detailed about my trouble.

You’re incredible! Thanks!

I am not sure where you are getting your info, but great topic.

I needs to spend some time learning more or understanding more.

Thanks for fantastic info I was looking for this information for my mission.

A motivating discussion is worth comment. There’s no doubt

that that you need to write more about this subject matter, it may not be a taboo matter but generally people do not speak about such subjects.

To the next! Cheers!!

These are actually enormous ideas in about blogging.

You have touched some pleasant points here. Any way keep up wrinting.

It is in reality a nice and useful piece of information. I’m glad that you shared this useful info

with us. Please keep us informed like this. Thank you for

sharing.

I seriously love your blog.. Great colors & theme. Did you develop this amazing site yourself?

Please reply back as I’m trying to create my own website and would like

to find out where you got this from or just what the theme is named.

Thanks!

Hello Dear, are you in fact visiting this website on a regular basis, if so then you will without doubt obtain pleasant knowledge.