Best Forex Swing Trading Strategy With Alligator Indicator

Friends……. Thanks a lot for visit here. This article earnmoneyfx.com research teams present Best Forex Swing Trading Strategy With Alligator Indicator as below.

Before exploring Best Forex Swing Trading Strategy With Alligator Indicator at first we learn to know

what is swing trading and What is Alligator Indicator.

What is Swing Trading?

Before applying the best forex swing trading strategy with the Alligator indicator, we must have to know what is swing trading.

Price never goes up or down with straight. Thus Price always goes up or down with zigzag or

swing.

In the Forex, Stock, and Commodities market various types of traders execute their trading. As like as

Position Trader, Breakout Trader, Momentum Trader, Swing Trader, Day Trader and

scalper etc.

Swing Trading is short term trading where traders try to achieve a profit within a short period

by using price swing.

The swing trader basically uses technical analysis to capture swing profit. Also, In addition, they add

fundamental analysis for confluence.

Swing trader always likes to trade trending market. Also, They always try to avoid the sideways market.

Swing trader’s rules are never investing in the long term. For that reason, they always invest in the short term. As like as In the daily chart five to ten days. Also, They execute their buy-sell in chart swing point.

What is Alligator?

Before applying the best forex swing trading strategy with the Alligator indicator, we must have to know what is alligator indicator is.

Alligator Indicator was introduced for the first time in 1995 by Bill Williams. Alligator consists of three

lines that represent the jaw, the teeth, and the lips. Also, Alligator Indicator helps traders to

identify the market situation, Is this market is sideways or trending? The Alligator indicator

can also help traders designate impulse and corrective wave formations, but the tool works

best when combined with a momentum indicator.

When Alligator is sleeping then her mouth is closed. That means the market is sideways now.

As long as Alligator sleep, Alligator will be more and hungrier.

Vice versa When Alligator wakes up and starts eating that means market is now trending.

Alligator Formula:

The Alligator indicator is common on Metatrader4 trading software and the calculation

formula sequence involves these straightforward steps:

1) The Alligator’s Jaw, the “Blue” line, is a 13-period Smoothed Moving Average, moved

into the future by 8 bars;

2) The Alligator’s Teeth, the “Red” line, is an 8-period Smoothed Moving Average, moved

by 5 bars into the future;

3) The Alligator’s Lips, the “Green” line, is a 5-period Smoothed Moving Average, moved

by 3 bars into the future.

Let’s explore how to enter and exit Swing Trading with Alligator.

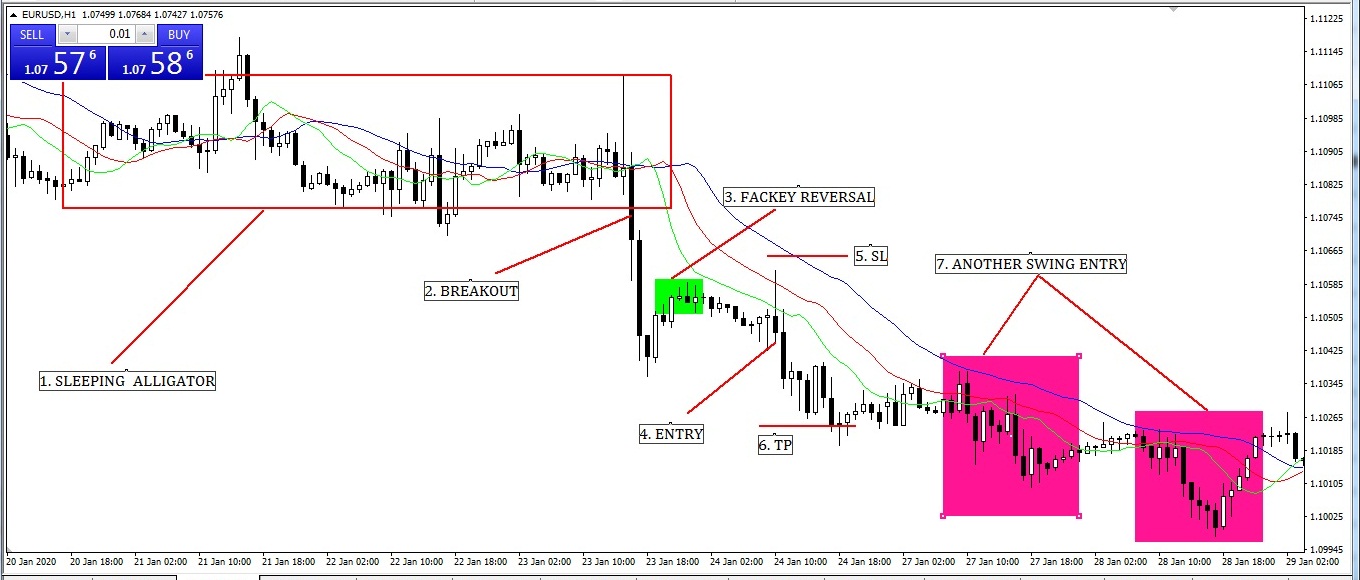

Image 1:

Swing Trading with Alligator Entry-Exit Strategy (SELL).

Let’s explore how the best swing trading strategy with the Alligator indicator works when you are going to SELL

Image point number – 1, We see the market is fully sideways. Also, alligator lines are in close

positions. That means Alligator is sleeping now. We know as long as Alligator sleep,

Breakout will be strong. Thus As a swing traders, we have nothing to do now. So we have to

wait for breakout sideways either up or down.

Image point number – 2, Candlesticks breakout sideways market. Also, Alligator lines are

going for each one. That means Alligator is now wake up. It’s dinner time of Alligator. And, This time

as a swing trader we have nothing to do now. So, We have to wait for the price come back Alligator

Line.

Image point number – 3, There we saw a fake reversal. We must have to ignore it because

as per Swing Trading With Alligator Entry-Exit Strategy, We never entry if price not come

Alligator line.

Image point number – 4, Candlesticks come back to the Alligator line. Thus we have to wait

for a reversal candlesticks pattern like Engulfing, Pin Bar, Inside the bar, etc. Here we saw

a strong long-tail pin bar. Great, It’s our Sell Signal. For that reason, aggressive or conservative trader put

their SELL STOP order 2 pips below of this reversal candlestick.

Image point number – 5, After hit SELL STOP order aggressive trader place STOP LOSS 2

pips above of reversal candlestick. Also, Conservative trader place STOP LOSS 2 pips above of

swing High.

Image point number – 6, Conservative or aggressive trader place their take profit level on

near swing Low or 1: 2 or 1 : 3 risk-reward ratio.

Image point number – 7, Another swing trading entry and exit as per rules.

Image 2:

Swing Trading with Alligator Entry-Exit Strategy (BUY).

Let’s explore how the best swing trading strategy with Alligator indicator works when you are going to BUY

Image point number – 1, We see the market is fully sideways. Also, alligator lines are close

positions. That means Alligator is sleeping now. We know as long as Alligator sleep,

Breakout will be strong. Thus As a swing trader, we have nothing to do now. So, We have to

wait for breakout sideways either up or down.

Image point number – 2, Candlesticks breakout sideways market. Also, Alligator lines are

going so far each one. That means Alligator is now wake up. It’s lunchtime of Alligator. This time

as a swing trader we have nothing to do now. So, We have to wait for the price come back Alligator

Line.

Image point number – 3, Candlesticks come back to the Alligator line. So we have to wait

for a reversal candlesticks pattern like Engulfing, Pin Bar, Inside the bar, etc. Here we saw

a strong long-tail pin bar. Great, It’s our BUY Signal. Thus, Aggressive or conservative trader put

their BUY STOP order 2 pips above of this reversal candlestick.

Image point number – 4, After hit BUY STOP order aggressive trader place STOP LOSS 2

pips below of reversal candlestick. Also, Conservative trader place STOP LOSS 2 pips below of

swing Low.

Image point number – 5, Conservative or aggressive trader place their take profit level on

near swing High or 1 : 2 or 1 : 3 risk-reward ratio.

Image point number – 6, Another swing trading entry and exit as per rules.

—— Thanks for giving- your valuable time to read this article ——–

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience

Wow that was odd. I just wrote an extremely long comment but after I clicked submit my comment didn’t

show up. Grrrr… well I’m not writing all that

over again. Regardless, just wanted to say superb blog!

I’m really impressed with your writing skills and

also with the layout on your weblog. Is this a paid theme or did you modify

it yourself? Either way keep up the nice quality writing, it is

rare to see a nice blog like this one today.

Hey I know this is off topic but I was wondering if you knew of any widgets I

could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some

experience with something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your

new updates.

Hi there! Someone in my Myspace group shared this site with us so I came to check it out.

I’m definitely loving the information. I’m book-marking and

will be tweeting this to my followers! Excellent blog and fantastic design.

Greate pieces. Keep posting such kind of information on your site.

Im really impressed by it.

Hello there, You’ve done a great job. I will certainly digg it and in my opinion suggest to my friends.

I am confident they’ll be benefited from this website.

Hello! I’ve been reading your web site for a long time now and finally got the bravery to go ahead and give you a

shout out from Huffman Tx! Just wanted

to mention keep up the good job!