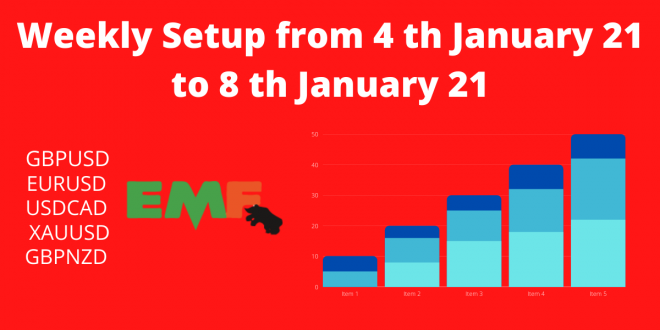

GBPUSD:

H4 Time Frame Trend: Up Trend with Channel.

(Plan-A)

Potential Long Zone:

At present price is on Upper Channel Line. If price wants to breakout channel

strongly to reach Monthly time frame Key Zone 1.395-1.42, then we will have

the long opportunity on H4 Key Level.

(Plan-B)

Potential Short Zone:

At present price is on Upper Channel Line. If price unable to break out the channel

strongly, then we will have a Short opportunity on the H4 Key Level.

EURUSD:

H4 Time Frame Trend: Up Trend with Channel.

(Plan-A)

Potential Long Zone:

At present, the price is near the Lower Channel Line. If price unable to breakdown

channel strongly, Then we will have the Long opportunity on H4 Lower Channel

Line.

(Plan-B)

Potential Short Zone:

At present, the price is near the Lower Channel Line. If price able to breakdown

channel strongly, Then we will have to wait for a retest on H4 Lower Channel

The line for Short.

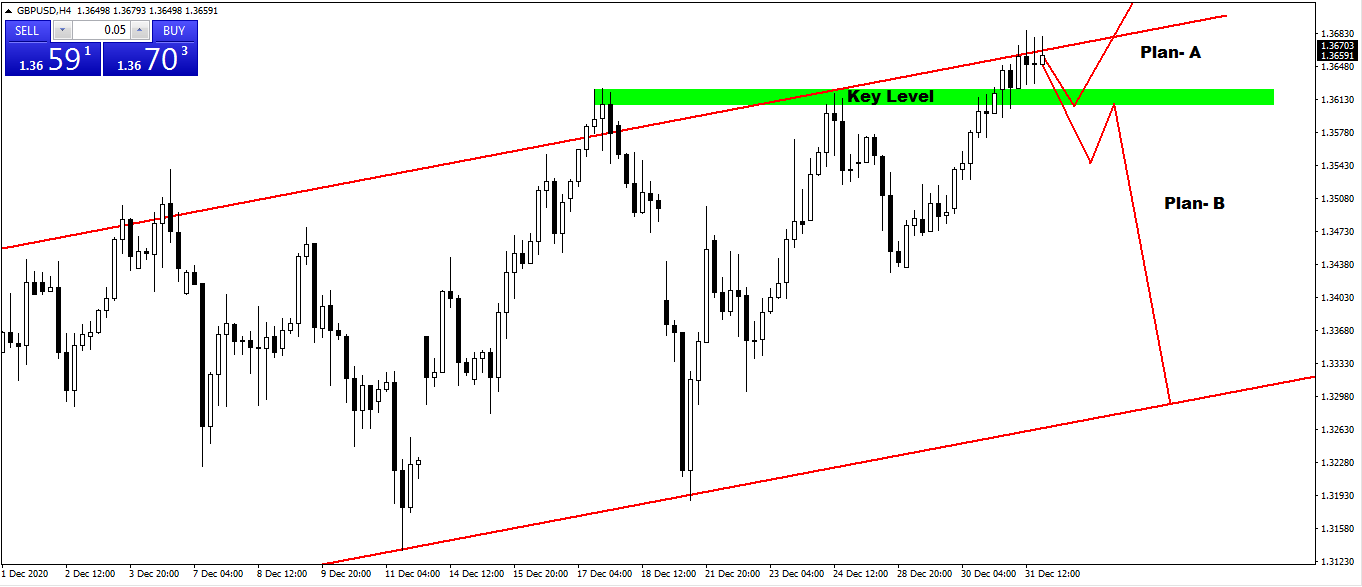

USDCAD:

H4 Time Frame Trend: Up Trend (Breakout Falling Wedge).

(Plan-A)

Potential Long Zone:

Long opportunity is here because the price is near Falling Wedge Re-test level and

Double Bottom. Also, the price touch Fibonacci Retracement 61.8.

(Plan-B)

Potential Short Zone:

If price unable to maintain a Falling Wedge and Double Bottom setup, then we

will have a Short opportunity on the confluence level.

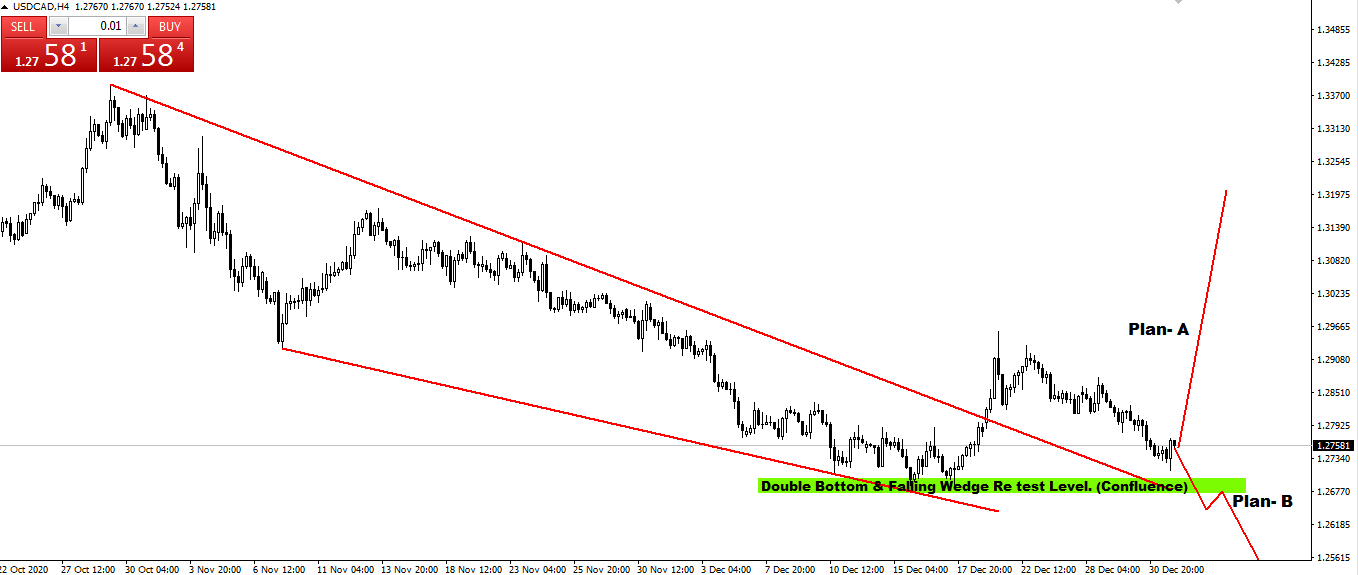

XAUUSD:

H4 Time Frame Trend: Up Trend with Rising Wedge.

(Plan-A)

Potential Long Zone:

At present price is near Lower Rising Wedge Line. If price unable to

breakdown Rising Wedge strongly, Then we will have the Long opportunity on H4

Lower Rising Wedge Line.

(Plan-B)

Potential Short Zone:

At present price is near Lower Rising Wedge Line. If price able to breakdown

Rising Wedge strongly, Then we will have to wait for a retest on H4 Lower

Rising Wedge Line for Short.

GBPNZD:

H4 Time Frame Trend: Sideways (Try to Breakout Reverse Head &

Shoulder).

(Plan-A)

Potential Long Zone:

At present price is sideways. If price able to breakout Reverse Head &

Shoulder strongly, Then we will have the Long opportunity on Reverse Head &

Shoulder neck Line.

(Plan-B)

Potential Short Zone:

At present price is sideways. If price unable to breakout Reverse Head &

Shoulder strongly, Then we will have Short opportunity on Reverse Head &

Shoulder neck Line.

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience