What is Volume?

The volume represents all the recorded trades for a security during a specified period.

This specified period can range from daily charts to 1-minute charts.

Most trading platforms, Trading-sim included, print each volume bar as either green or red.

Green bars are printed if the stock closes up for a period and red bars indicate a stock closed lower for a given period.

This color-coding need not mean there was more down or up the volume for the period;

it just represents how the stock closed.

Volume cuts through all the noise in Level 2, by showing you where traders are actually placing their money.

In this article, we will cover how to assess the volume indicator to help us determine the market’s intentions across four common day trading setups:

Breakouts

Trending Stocks

Volume Spikes

False Breakouts

In addition, we will discuss advanced volume analysis techniques and apply these methods to assess the strength of the equities and bitcoin markets

Breakouts and Volume:

Learn to Trade Stocks, Futures, and ETFs Risk-Free

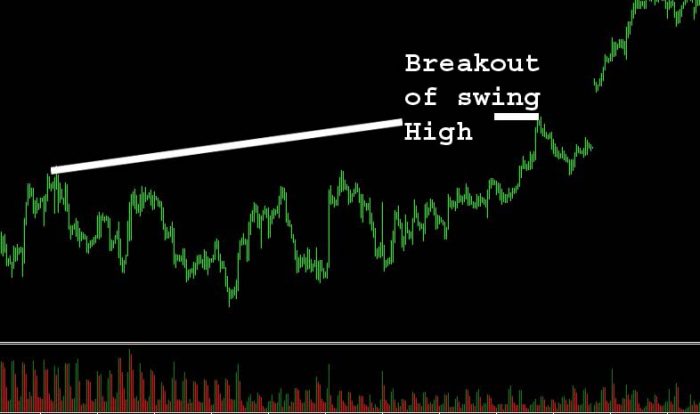

Traders will look for breaks of support and resistance to enter positions. For those fans of the Tradingsim blog, you know that I trade breakouts

on the morning of each session. There are two key components to confirm a breakout: price and volume [2]. When stocks break critical levels without

volume, you should consider the breakout suspect and prime for a reversal of the highs/lows.

The below chart is of Netflix at a 5-minute time interval. You will notice that Netflix was up ~15% throughout the day after a significant gap up.

Can you tell me what happened to Netflix after the breakout of the early 2015 swing high?

The interesting thing about the Netflix chart is the stock never made a new high after the first 5-minute bar.

This is a prime example where a stock may have broken a high from a few weeks ago but is unable to break the high for the current day.

As day traders, you want to wait until the high of the day is broken with volume.

A key point for you is every swing high does not need to exceed the previous swing high with more volume.

I used to obsess over this and if I didn’t see more volume I would walk away from the trade. Looking at the chart of Netflix above,

do you honestly think the stock will exceed the first 5-minute bar with increased volume? Of course not!

While this charting example did not include a break of the daily high, when you look for stocks that are breaking highs, just look for heavy volume.

Please don’t beat yourself up because the 9:35 bar had 150,000 shares traded and the break of the high at 10:10 am only had 132,000.

Now if you see a break of a high with 50% or 70% less volume, this is another story.

Again, if we are within the margins, please do not beat yourself up over a few thousand shares.

In a perfect world, the volume would expand on the breakout and allow you to eat most of the gains on the impulsive move higher.

Below is an example of this scenario.

Let’s test to see if you are picking up the concepts of breakouts with volume.

Take a look at the below chart without scrolling too far and tell me if the stock will continue in the direction of the trend or reverse?

Come on, don’t cheat!

Answer to my Question

The answer to my question – you have no idea if the stock will have a valid breakout. From the chart, you could see that the stock

had a nice down volume and only one green candle before the breakdown took place. This is where experience and money management comes

into play because you have to take a chance on the trade.

You would have known you were in a winner once you saw the volume pick up on the breakdown as illustrated in the chart and the price

the action began to break down with ease.

This concept of increasing volume on a breakout was also stated in the book Mastering Technical Analysis. In one excerpt, author xxx

mentioned,” Dow Dow recognized the importance of volume in confirming the strength of a trend. While a secondary indication,

if the volume did not increase in the direction of the trend, this was a warning sign that the trend may not be valid.”

For those that follow the blog, you know that I like to enter the position on a new daily high with increased volume.

You will need to place your stops slightly below the high to ensure you are not caught in a trap. This strategy works

for both long and short positions. The key again is looking for the expansion in volume prior to entering the trade.

In Summary

The stock has volatile price action with most of the candle color

mirroring the direction of the primary trend (i.e. red candles for a breakdown and green candles for a breakout).

On the breakout,

volume should pick up.

The price action after the breakout should move swiftly in your favor.

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience