Chart Pattern with alligator strategies is the most useful indicator for technical analysts. When chart

pattern use with alligator indicator, it will highly risk-reward ratio strategy.

In this lesson, you will discover how to use alligator indicator with chart

patterns properly.

Just follow earnmoneyfx.com provided rules properly.

Many types of chart patterns you will find in the forex, equity, commodity,

metal, crypto chart. As below here, we discussed the most repeatable chart

pattern. They are….Chart Pattern with alligator strategies

Alligator Indicator with Double Top Chart Pattern Entry-Exit

Strategy

Alligator Indicator with Double Bottom Chart Pattern Entry-Exit

Strategy

Alligator Indicator with Head and Shoulder Chart Pattern Entry-Exit

Strategy

Alligator Indicator with Inverse Head and Shoulder Chart Pattern

Entry-Exit Strategy

Alligator Indicator with Triple Top Chart Pattern Entry-Exit Strategy

Alligator Indicator with Triple Bottom Chart Pattern Entry-Exit

Strategy

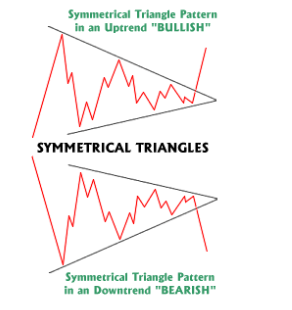

Alligator Indicator with Symmetrical Triangle Chart Pattern Entry-

Exit Strategy

Alligator Indicator with Ascending Triangle Chart Pattern Entry-Exit

Strategy

Alligator Indicator with Descending Triangle Chart Pattern Entry-

Exit Strategy

Alligator Indicator with Bullish Channel Pattern Entry-Exit Strategy

Alligator Indicator with Bearish Channel Pattern Entry-Exit Strategy

Alligator Indicator with Bullish Flag Pattern Entry-Exit Strategy

Alligator Indicator with Bearish Flag Pattern Entry-Exit Strategy

Chart Pattern with alligator strategies is a nice strategy

What is Alligator Indicator?

According to Investopedia, Extraordinary broker Bill Williams, an early

pioneer of the market brain research, built up the pattern following Alligator

marker, which follows the reason that monetary business segment and

individual protections pattern only 15% to 30% of the time while pounding

through sideways ranges the other 70% to 85% of the time.

Williams accepted that people and foundations will in normal, gather the

majority of their benefit’s during firmly drifting times.

The Williams Alligator pointer is a specialized identification apparatus that

utilizations smoothed moving midpoints.

The pointer utilizes a smoothed normal determined with a simple moving

(SMA) to begin.

It utilizes three moving midpoints, set at 5, 8, 13 periods. The three moving

midpoints include the Jaw, Teeth, and Lips of the Alligator.

The pointer applies union disparity connections to construct exchanging

signals, with the Jaw making the slowest turns and the Lips making the

quickest turns.

How the Willaims Alligator Indicator Works:

The Alligator pointer utilizes three smoothed moving midpoints, set at five,

eight, and 13 periods, which are all Fibonacci numbers.

The underlying smoothed normal is determined with a straightforward

moving normal (SMA), including extra smoothed midpoints that hinder

pointer turns.

Computation of the Alligator Indicator:

Straightforward moving normal (SMA):

SUM1 = SUM (CLOSE, N)

SMMA1 = SUM1/N

Ensuing qualities are:

PREVSUM = SMMA(i-1) *N

SMMA(i) = (PREVSUM-SMMA(i-1)+CLOSE(i))/N

Where:

SUM1 – the total of shutting costs for N periods;

PREVSUM – smoothed total of the past bar;

SMMA1 – smoothed moving normal of the principal bar;

SMMA(i) – smoothed moving normal of the current bar (aside from the first);

CLOSE(i) – current shutting cost;

N – the smoothing time frame.

How the pointer is determined is significant for understanding the internal

activities of the marker. Fortunately, the computation isn't needed practically

speaking. The Alligator marker can be added to your outlines from the pointer

list in your diagramming or exchanging stage.

The three moving midpoints involve the Jaw, Teeth, and Lips of the Alligator,

opening, and shutting in response to developing patterns and exchanging

ranges:

Jaw (blue line): Starts with the 13-bar SMMA and is smoothed by eight bars

on resulting esteems.

Teeth (red line): Starts with the eight-bar SMMA and is smoothed by five

bars on ensuing qualities.

Lips (green line): Starts with the five-bar SMMA and smoothed by three bars

on ensuing qualities.

Williams summoned farm symbolism to portray the pointer, noticing " even a

the visually impaired chicken will discover it’s corn on the off chance that it is

constantly taken care of simultaneously … it took us years however we have

created a marker that lets us generally keep our powder dry until we arrive

at the visually impaired chicken's the market."

Chart Pattern with alligator strategies very important for the forex market

What is Chart Pattern?

According to Wikipedia, A chart pattern is a pattern within a chart when

prices are graphed. In forex, stock, crypto, metal, and commodity

markets trading, chart pattern studies play a large role during technical

analysis. When data plotted there is usually any pattern that naturally occurs

and repeats over a period. Chart patterns are basically used as either reversal

or continuation signals.

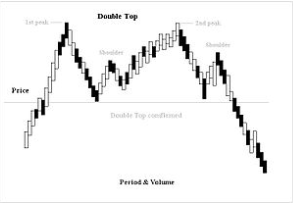

Alligator Indicator with Double Top Chart Pattern Entry-Exit

Strategy:

Double Top Chart Pattern:

A double top chart pattern is another

pattern that traders use to highlight trend reversals. An asset’s price will

experience a peak, before retracing back to a level of support. It will then

climb up once more before reversing back more permanently against the

current trend.

Image point number – 1, Candlesticks close above alligator indicator

with full of impulsive. You have to watch the market because anything

can happen here. It will be any chart or candlesticks pattern.

Image point number- 2, After impulsive mode price creates 1 st top.

Sellers try to be powerful here.

Image point number- 3, Hmm… Sellers are powerful here thus price is

corrective mode now. But it’s time to wait and observe.

Image point number – 4, After corrective mode buyer is trying to

strong here. Wait for reversal candlesticks pattern.

Image point number – 5, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. 2nd top created. Time to wait and observe to create a

double top chart pattern.

Image point number – 6, After created 2 nd top sellers are more

powerful here. Here be a chance to create a double top pattern. Thus

you have to draw a neckline.

Image point number – 7, Neckline breakdown by candlesticks. Also,

candlesticks close below the neckline. It confirms a double top pattern.

It’s entry time.

Image point number – 8, Aggressive trader short close price of

neckline breakdown candlesticks.

Image point number – 9, Aggressive trader place stop loss above of

neckline breakdown candlesticks.

Image point number –10, Conservative trader put SELL STOP order

two to five pips below of neckline breakdown candlesticks.

Image point number – 11, After hit SELL STOP order conservative

traders have to place STOP LOSS two to five pips above of neckline

breakdown candlesticks.

Image point number – 12, Conservative or aggressive traders place

take profit level near swing low or 1: 2 more risk-reward ratio as per

their choice.

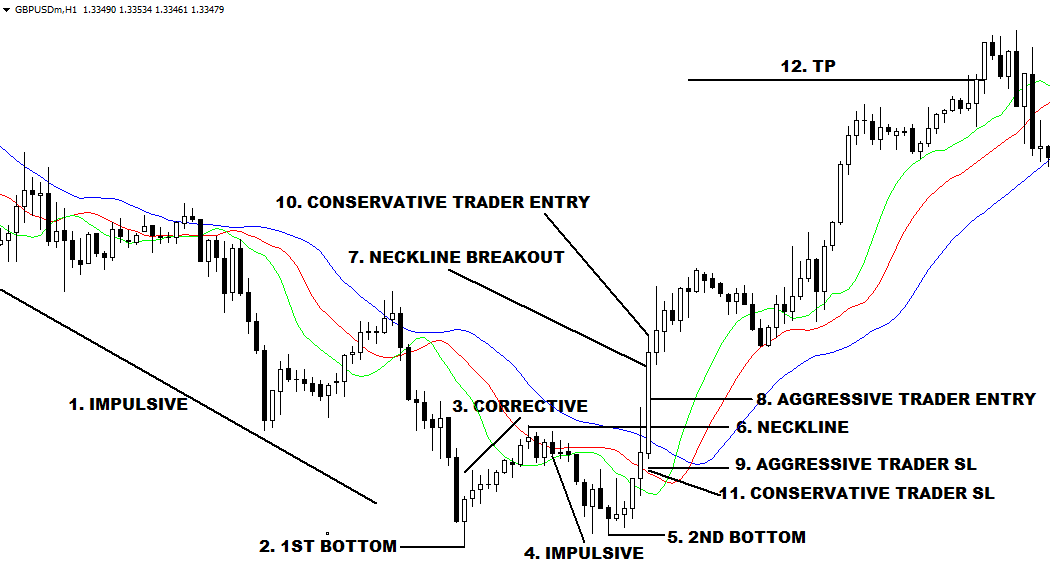

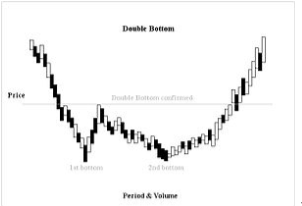

Alligator Indicator with Double Bottom Entry-Exit Strategy:

Double Bottom Chart Pattern:

A double bottom chart pattern is

another pattern that traders use to highlight trend reversals. An asset’s price

will experience a bottom, before retracing back to a level of resistance. It will

then climb up once more before reversing back more permanently against the

current trend.

Image point number – 1, Candlesticks close below alligator indicator

with full of impulsive. You have to watch the market because anything

can happen here. It will be any chart or candlesticks pattern.

Image point number- 2, After impulsive mode price creates 1 st bottom.

Buyers try to be powerful here.

Image point number- 3, Hmm… Buyers are powerful here thus price is

corrective mode now. But it’s time to wait and observe.

Image point number – 4, After corrective mode sellers are trying to

strong here. Wait for reversal candlesticks pattern.

Image point number – 5, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. 2nd bottom created. Time to wait and observe to

create a double bottom chart pattern.

Image point number – 6, After created 2 nd bottom buyers are more

powerful here. Here be a chance to create a double bottom pattern. Thus

you have to draw a neckline.

Image point number – 7, Neckline breakout by candlesticks. But

candlesticks do not close above the neckline. It confirms the double

bottom pattern. It’s entry time.

Image point number – 8, Aggressive trader long above neckline.

Image point number – 9, Aggressive trader place stop loss below of

neckline breakdown candlesticks.

Image point number –10, Conservative trader put BUY STOP order

two to five pips above of neckline breakout candlesticks.

Image point number – 11, After hit BUY STOP order conservative

traders have to place STOP LOSS two to five pips below of neckline

breakout candlesticks.

Image point number – 12, Conservative or aggressive traders place

take profit level near swing high or 1: 2 more risk-reward ratio as per

their choice.

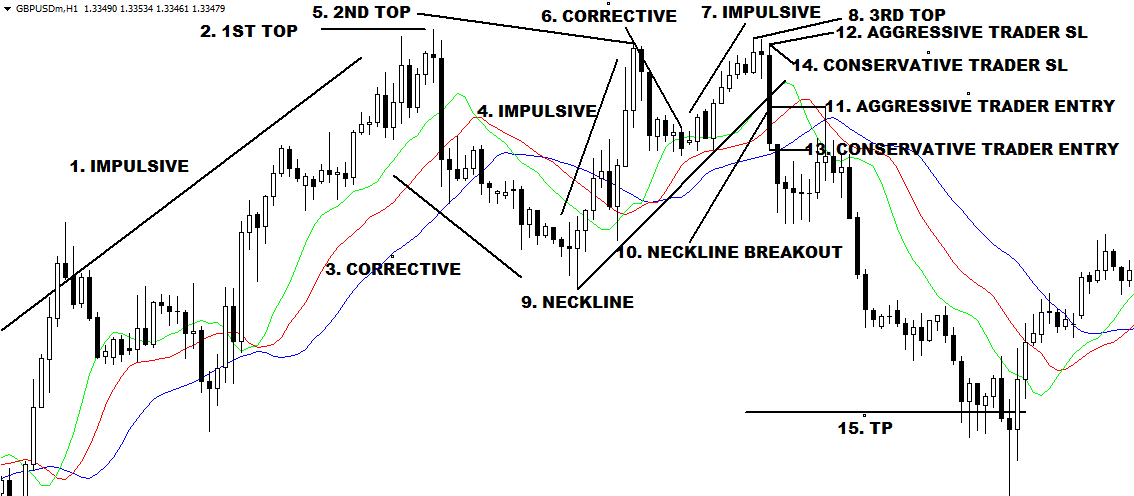

Alligator Indicator with Triple Top Chart Pattern Entry-Exit

Strategy:

Triple Top Chart Pattern:

A triple top chart pattern is another pattern that

traders use to highlight trend reversals. An asset’s price will experience a

triple peak, before retracing back to a level of support. It will then climb up

once more before reversing back more permanently against the current trend.

Image point number – 1, Candlesticks close above alligator indicator

with full of impulsive. You have to watch the market because anything

can happen here. It will be any chart or candlesticks pattern.

Image point number- 2, After impulsive mode price creates 1 st top.

Sellers try to be powerful here.

Image point number- 3, Hmm… Sellers are powerful here thus price is

corrective mode now. But it’s time to wait and observe.

Image point number – 4, After corrective mode buyer is trying to

strong here. Wait for reversal candlesticks pattern.

Image point number- 5, After impulsive mode price creates 2 nd top.

Sellers try to be powerful here.

Image point number- 6, Hmm… Sellers are powerful here again thus

price is corrective mode now. But it’s time to wait and observe.

Image point number – 7, After corrective mode buyer is again trying to

strong here. Wait for reversal candlesticks pattern.

Image point number – 8, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. 3 rd top created. Time to wait and observe to create

a triple top chart pattern.

Image point number – 9, After created 3 rd top sellers are more

powerful here. Here be a chance to create a triple top pattern. Thus you

have to draw a neckline.

Image point number – 10, Neckline breakdown by candlesticks. Also,

candlesticks close below the neckline. It confirms the triple top pattern. Its

entry time.

Image point number – 11, Aggressive trader short on neckline

breakdown.

Image point number – 12, Aggressive trader place stop loss above of

neckline breakdown candlesticks.

Image point number –13, Conservative trader put SELL STOP order

two to five pips below of neckline breakdown candlesticks.

Image point number – 14, After hit SELL STOP order conservative

traders have to place STOP LOSS two to five pips above of neckline

breakdown candlesticks.

Image point number – 15, Conservative or aggressive traders place

take profit level near swing low or 1: 2 more risk-reward ratio as per

their choice.

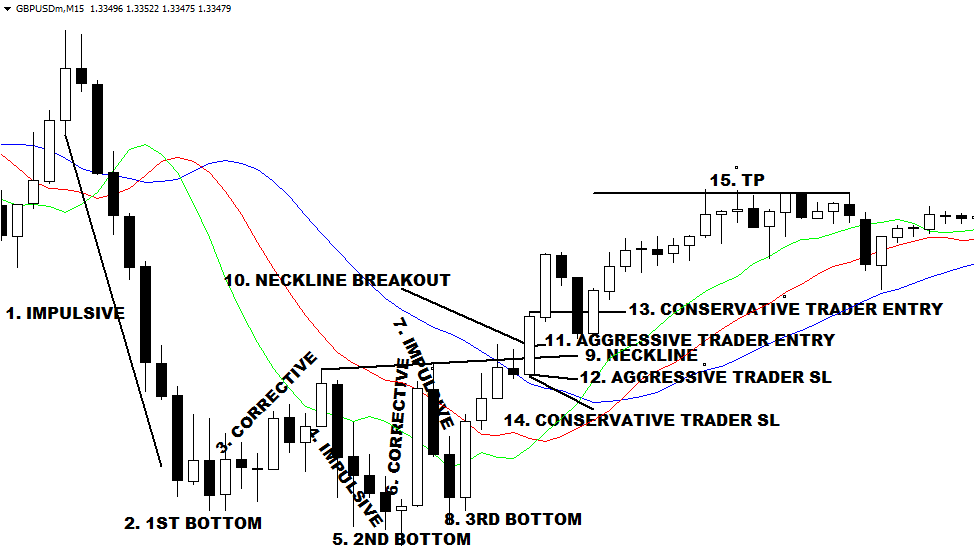

Alligator Indicator with Triple Bottom Entry-Exit Strategy:

Triple Bottom Chart Pattern:

A triple bottom chart pattern is another pattern that

traders use to highlight trend reversals. An asset’s price will experience a

triple bottom, before retracing back to a level of resistance. It will then climb

up once more before reversing back more permanently against the current

trend.

Image point number – 1, Candlesticks close below alligator indicator

with full of impulsive. You have to watch the market because anything

can happen here. It will be any chart or candlesticks pattern.

Image point number- 2, After impulsive mode price creates 1 st bottom.

Buyers try to be powerful here.

Image point number- 3, Hmm… Buyers are powerful here thus price is

corrective mode now. But it’s time to wait and observe.

Image point number – 4, After corrective mode sellers are trying to

strong here. Wait for reversal candlesticks pattern.

Image point number – 5, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. 2nd bottom created.

Image point number- 6, Hmm… Buyers are again powerful here thus

price is corrective mode now. But it’s time to wait and observe.

Image point number – 7, After corrective mode sellers are again trying

to strong here. Wait for reversal candlesticks pattern.

Image point number – 8, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. 3 rd bottom created. Time to wait and observe to create

a triple bottom chart pattern.

Image point number – 9, After created 3 rd bottom buyers are more

powerful here. Here be a chance to create the triple bottom pattern. Thus

you have to draw a neckline.

Image point number – 10, Neckline breakout by candlesticks. But

candlesticks do not close above the neckline. It confirms the triple

bottom pattern. It’s entry time.

Image point number – 11, Aggressive trader long above neckline.

Image point number – 12, Aggressive trader place stop loss below of

neckline breakout candlesticks.

Image point number –13, Conservative trader put BUY STOP order

two to five pips above of neckline breakout candlesticks.

Image point number – 14, After hit BUY STOP order conservative

traders have to place STOP LOSS two to five pips below of neckline

breakout candlesticks.

Image point number – 15, Conservative or aggressive traders place

take profit level near swing high or 1: 2 more risk-reward ratio as per

their choice.

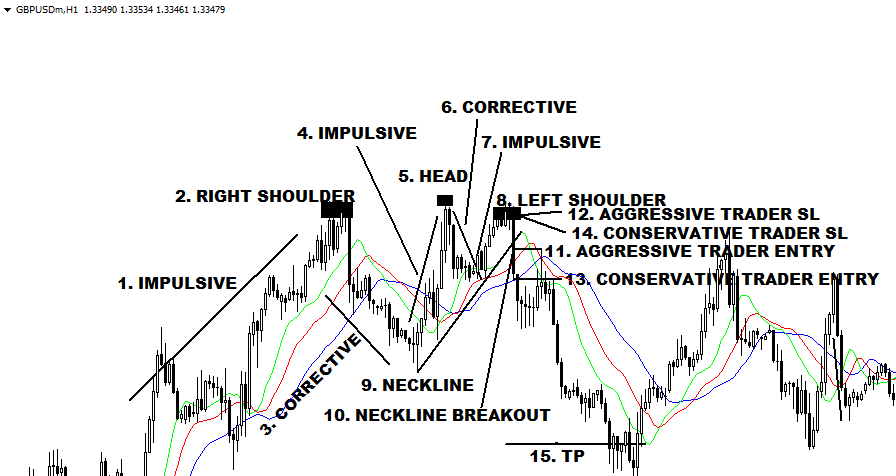

Alligator Indicator with Head & Shoulder Chart Pattern Entry-

Exit Strategy:

Head & Shoulder Chart Pattern:

Head and shoulders are that chart pattern in

which a large peak has a slightly smaller peak on either side of it. Traders look

at head and shoulders patterns for bullish to bearish reversal prediction.

The first and third peaks will be smaller than the second, but they will all fall back

to the same level of support, which is known as the ‘neckline’. Once the third

peak breaks the level of support, it will likely break down into a bearish

downtrend.

Image point number – 1, Candlesticks close above alligator indicator

with full of impulsive. You have to watch the market because anything

can happen here. It will be any chart or candlesticks pattern.

Image point number- 2, After impulsive mode price creates the right

shoulder. Sellers try to be powerful here.

Image point number- 3, Hmm… Sellers are powerful here thus price is

corrective mode now. But it’s time to wait and observe.

Image point number – 4, After corrective mode buyer is trying to

strong here. Wait for reversal candlesticks pattern.

Image point number- 5, After impulsive mode price creates head.

Sellers try to be powerful here.

Image point number- 6, Hmm… Sellers are powerful here again thus

price is corrective mode now. But it’s time to wait and observe.

Image point number – 7, After corrective mode buyer is again trying to

strong here. Wait for reversal candlesticks pattern.

Image point number – 8, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. Left shoulder created. Time to wait and observe for

creating head and shoulder chart patterns.

Image point number – 9, After created left shoulder sellers are more

powerful here. Here be a chance to create a head and shoulder chart

pattern. Thus you have to draw a neckline.

Image point number – 10, Neckline breakdown by candlesticks. Also,

candlesticks close below the neckline. It confirms head and shoulder

chart pattern. It’s entry time.

Image point number – 11, Aggressive trader short on neckline

breakdown.

Image point number – 12, Aggressive trader place stop loss above of

neckline breakdown candlesticks.

Image point number –13, Conservative trader put SELL STOP order

two to five pips below of neckline breakdown candlesticks.

Image point number – 14, After hit SELL STOP order conservative

traders have to place STOP LOSS two to five pips above of neckline

breakdown candlesticks.

Image point number – 15, Conservative or aggressive traders place

take profit level near swing low or 1: 2 more risk-reward ratio as per

their choice.

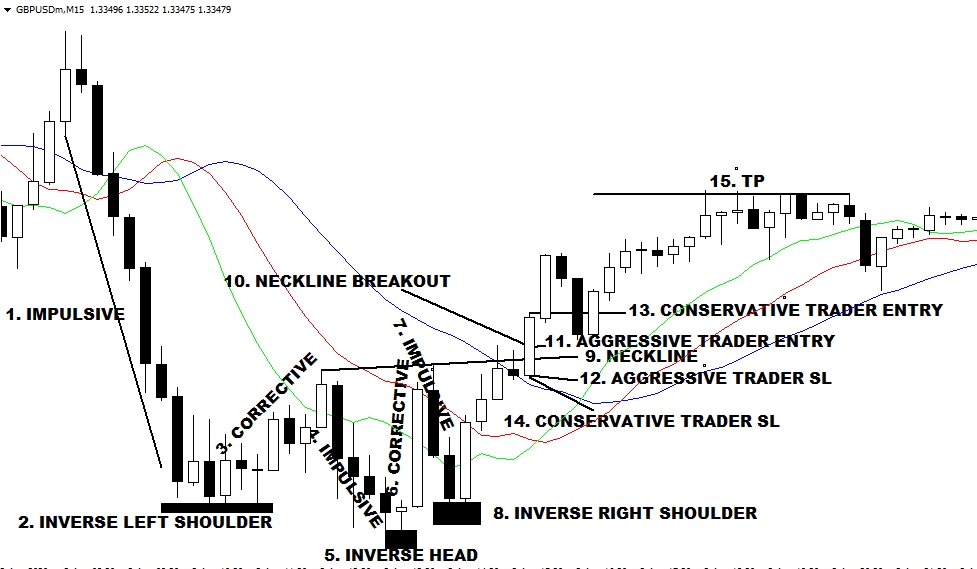

Alligator Indicator with Inverse Head & Shoulder Entry-Exit

Strategy:

Inverse Head & Shoulder Chart Pattern:

Inverse Head and shoulders is that chart

the pattern in which a large bottom has a slightly smaller bottom on either side of

it. Traders look at inverse head and shoulders patterns for bearish to bullish

reversal prediction.

The first and third-bottom will be higher than the second, but they will all fall

back to the same level of resistance, which is known as the ‘neckline’. Once

the third peak breaks the level of resistance, it will likely break out into a

bullish uptrend.

Image point number – 1, Candlesticks close below alligator indicator

with full of impulsive. You have to watch the market because anything

can happen here. It will be any chart or candlesticks pattern.

Image point number- 2, After impulsive mode price creates inverse

left shoulder. Buyers try to be powerful here.

Image point number- 3, Hmm… Buyers are powerful here thus price is

corrective mode now. But it’s time to wait and observe.

Image point number – 4, After corrective mode sellers are trying to

strong here. Wait for reversal candlesticks pattern.

Image point number – 5, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. Inverse head created.

Image point number- 6, Hmm… Buyers are again powerful here thus

price is corrective mode now. But it’s time to wait and observe.

Image point number – 7, After corrective mode sellers are again trying

to strong here. Wait for reversal candlesticks pattern.

Image point number – 8, After reversal candlesticks price again

impulsive here. As a chart pattern trader, you have to wait to find out

any chart pattern. Inverse right shoulder was created. Time to wait and

observe to create inverse head & shoulder chart pattern.

Image point number – 9, After created inverse right shoulder buyers

are more powerful here. Here be a chance to create inverse head &

shoulder chart pattern. Thus you have to draw a neckline.

Image point number – 10, Neckline breakout by candlesticks. But

candlesticks do not close above the neckline. It confirms inverse head &

shoulder chart pattern. It’s entry time.

Image point number – 11, Aggressive trader long above neckline.

Image point number – 12, Aggressive trader place stop loss below of

neckline breakout candlesticks.

Image point number –13, Conservative trader put BUY STOP order

two to five pips above of neckline breakout candlesticks.

Image point number – 14, After hit BUY STOP order conservative

traders have to place STOP LOSS two to five pips below of neckline

breakout candlesticks.

Image point number – 15, Conservative or aggressive traders place

take profit level near swing high or 1: 2 more risk-reward ratio as per

their choice.

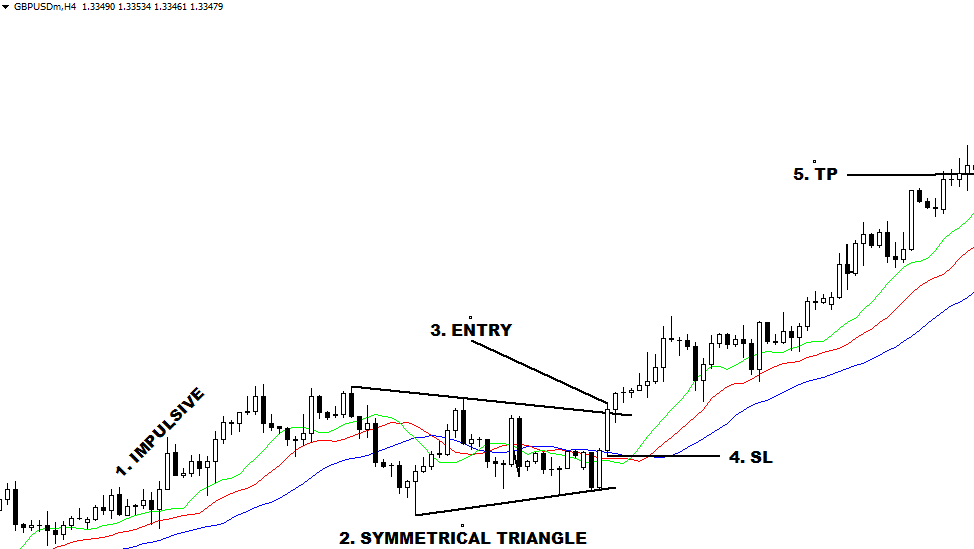

Alligator Indicator with Symmetrical Triangle Chart Pattern

Entry-Exit Strategy (BUY):

What is the Symmetrical Triangle:

The Symmetrical Triangle is the area of indecision where the present price is a

pause with future direction is questionable. And demand and supply are equal

at this time.

Image point number – 1, Candlesticks close above alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be long or short opportunity.

Image point number- 2, After impulsive mode price creates top. Sellers

try to be powerful here.

Hmm… Sellers are powerful here thus price is corrective mode now.

Also, create the bottom. But it’s time to wait and observe.

After corrective mode buyer is trying to be strong here. Also, create

another top that is not high from the previous top. Wait for reversal

candlesticks pattern.

Hmm… again sellers are powerful here thus prices are in the corrective mode

now. Also, create another bottom that is not low as the previous bottom. But

it’s time to wait and observe.

After impulsive mode price creates a symmetrical triangle. Wait for a

symmetrical triangle breakout.

Image point number –3, Conservative or Aggressive trader put their

BUY STOP order two to five pips above of the symmetrical triangle

breakout candlesticks.

Image point number – 4, After hit BUY STOP order you have to place

STOP LOSS two to five pips below of symmetrical triangle breakout

candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level symmetrical triangle profit target or near swing

high or 1: 2 more risk-reward ratio as per their choice.

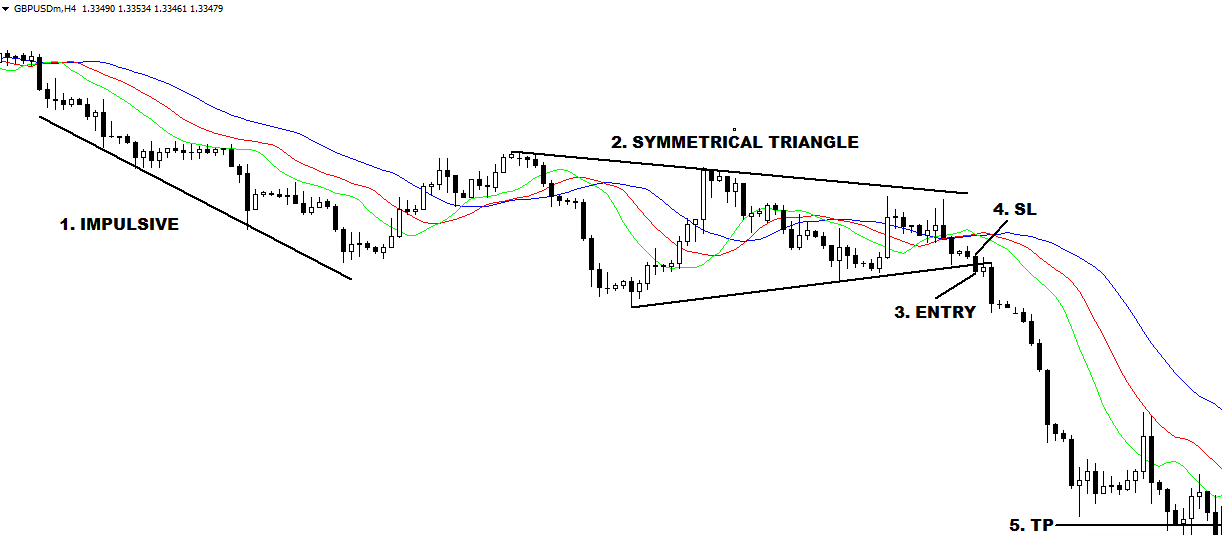

Alligator Indicator with Symmetrical Triangle Chart Pattern

Entry-Exit Strategy (SELL):

Image point number – 1, Candlesticks close below alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be a long or short opportunity.

Image point number- 2, After impulsive mode price creates the bottom.

Buyers try to be powerful here.

Hmm… Buyers are powerful here thus prices are in the corrective mode now.

Also, create a top. But it’s time to wait and observe.

After corrective mode sellers are trying to strong here. Also, create

another bottom that is not high of the previous low. Wait for reversal

candlesticks pattern.

Hmm… again buyers are powerful here thus prices are in the corrective mode

now. Also, create another bottom that is not the low of the previous high. But

it’s time to wait and observe.

After impulsive mode price creates a symmetrical triangle. Wait for

a symmetrical triangle breakdown.

Image point number –3, Conservative or Aggressive trader put their

SELL STOP order two to five pips below of the symmetrical triangle

breakdown candlesticks.

Image point number – 4, After hit SELL STOP order you have to place

STOP LOSS two to five pips above of symmetrical triangle breakdown

candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level symmetrical triangle profit target or near swing

low or 1: 2 more risk-reward ratio as per their choice.

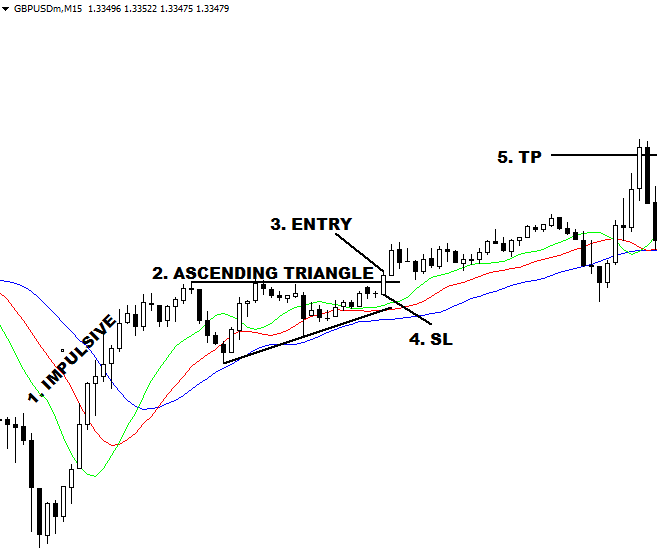

Alligator Indicator with Ascending Triangle Chart Pattern

Entry-Exit Strategy:

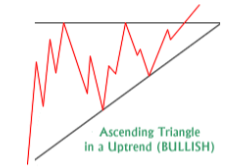

What is the Ascending Triangle:

It’s the symmetrical triangle variation and bullish formation. Its create in

uptrend with most reliable.

The top part of the ascending triangle looks flat and the bottom part created

higher low with several times.

Above the image of the Ascending Triangle Pattern, we found below things.

Price reaches a higher high position.

Thereafter prices are corrected and turned back.

Few time later prices try to touch the previous high.

Thereafter prices are again corrective and turned back.

Lastly, the price creates new high and bulls are taking full of control.

Minimum two flat tops and two higher low required to creating the ascending

triangle is bullish.

Image point number – 1, Candlesticks close above alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be a long or short opportunity.

Image point number- 2, After impulsive mode price creates top. Sellers

try to be powerful here.

Hmm… Sellers are powerful here thus prices are in the corrective mode now.

Also, create the bottom. But it’s time to wait and observe.

After corrective mode buyers are trying to strong here. Also, create

another top that is also equal to the previous top. Wait for reversal

candlesticks pattern.

Hmm… again sellers are powerful here thus prices are in the corrective mode

now. Also, create another bottom that is not low as the previous bottom.

But it’s time to wait and observe.

After impulsive mode price creates ascending triangle. Wait for

ascending triangle breakout.

Image point number –3, Conservative or Aggressive trader put their

BUY STOP order two to five pips above of the ascending triangle

breakout candlesticks.

Image point number – 4, After hit BUY STOP order you have to place

STOP LOSS two to five pips below of ascending triangle breakout

candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level ascending triangle profit target or near swing high

or 1: 2 more risk-reward ratio as per their choice.

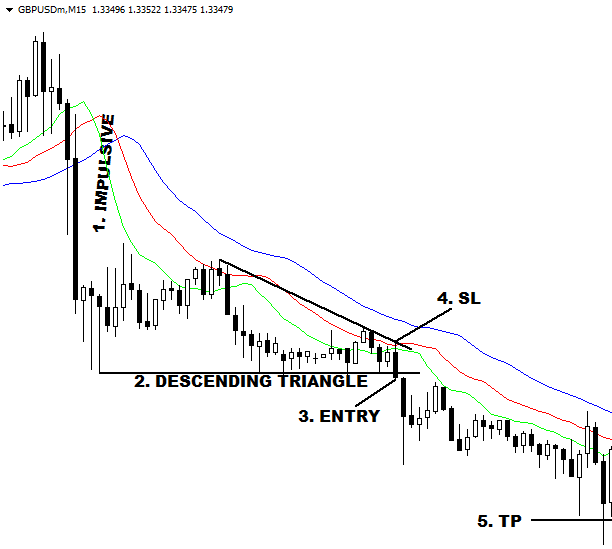

Alligator Indicator with Descending Triangle Chart Pattern

Entry-Exit Strategy:

What is the Descending Triangle:

It’s the symmetrical triangle variation with bearish formation. Its create down

the trend with the most reliable.

The bottom part of the Descending triangle looks flat and the upper part create

lower high severally.

Above the image of Descending Triangle Pattern, we found below things.

Price reaches a lower low position.

Thereafter price was corrected and turned back.

A few times later prices try to touch the previous low.

Thereafter price was corrected and turned back.

Lastly, prices create new lows and bears are taking full control.

Minimum two flat bottom and two lower high required to create the

descending triangle in bearish.

Image point number – 1, Candlesticks close below alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be a long or short opportunity.

Image point number- 2, After impulsive mode price creates the bottom.

Buyers try to be powerful here.

Hmm… Buyers are powerful here thus prices are in the corrective mode now.

Also, create a top. But it’s time to wait and observe.

After corrective mode sellers are trying to strong here. Also, create

another bottom that is equal to the previous low. Wait for reversal

candlesticks pattern.

Hmm… again buyers are powerful here thus prices are in the corrective mode

now. Also, create another bottom that is not high of the previous high. But

it’s time to wait and observe.

After impulsive mode price creates descending triangle. Wait for

descending triangle breakdown.

Image point number –3, Conservative or Aggressive trader put their

SELL STOP order two to five pips below of the descending triangle

breakdown candlesticks.

Image point number – 4, After hit SELL STOP order you have to place

STOP LOSS two to five pips above of descending triangle breakdown

candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level descending triangle profit target or near swing

low or 1: 2 more risk-reward ratio as per their choice.

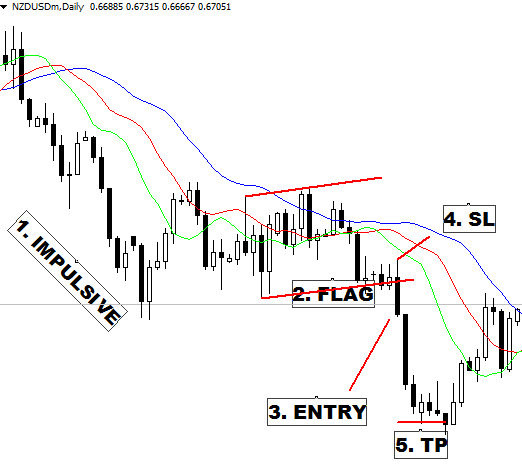

Alligator Indicator with Bearish Flag Pattern Entry-Exit

Strategy :

What is Flag Pattern:

The Flag Pattern is a continuation pattern. It finds out in the chart after massive or

big bullish or bearish movement. Research has shown that Flag Pattern is one

of the most reliable continuation patterns.

Above the image of the Flag Pattern, we found the below things.

Bullish Flag must have lower tops and lower bottoms. And the pattern

goes against the uptrend but the channel go ahead with parallel.

Bearish Flag must have higher tops and higher bottoms. And the pattern goes

against downtrend but the channel go ahead with parallel.

Minimum two lower tops and two lower bottoms required for a bullish flag

pattern.

Minimum two higher tops and two higher bottoms required for bearish flag

pattern.

Image point number – 1, Candlesticks close below alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be a long or short opportunity.

Image point number- 2, After impulsive mode price creates the bottom.

Buyers try to be powerful here.

Hmm… Buyers are powerful here thus prices are in the corrective mode now.

Also, create a top. But it’s time to wait and observe.

After corrective mode sellers are trying to strong here. Also, create

another bottom that is not the low of the previous low. Wait for reversal

candlesticks pattern.

Hmm… again buyers are powerful here thus prices are corrective mode

now. Also, create another bottom which is high of the previous high. But it’s

time to wait and observe.

After impulsive mode price creates a bearish flag pattern. Wait for a bearish

flag pattern breakdown.

Image point number –3, Conservative or Aggressive trader put their

SELL STOP order two to five pips below of the bearish flag breakdown

candlesticks.

Image point number – 4, After hit SELL STOP order you have to place

STOP LOSS two to five pips above of bearish flag breakdown

candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level bearish flag profit target or near swing low or 1: 2

more risk-reward ratio as per their choice.

Alligator Indicator with Bullish Flag Pattern Entry-Exit

Strategy:

Image point number – 1, Candlesticks close above alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be a long or short opportunity.

Image point number- 2, After impulsive mode price creates a top. Sellers

try to be powerful here.

Hmm… Sellers are powerful here thus prices are in the corrective mode now.

Also, create the bottom. But it’s time to wait and observe.

After corrective mode buyers are trying to strong here. Also, create

another top that is not high from the previous top. Wait for reversal

candlesticks pattern.

Hmm… again sellers are powerful here thus prices are in the corrective mode

now. Also, create another bottom that is low than the previous bottom. But

it’s time to wait and observe.

After impulsive mode price creates a channel pattern. Wait for bullish flag

pattern breakout.

Image point number –3, Conservative or Aggressive trader put their

BUY STOP order two to five pips above of the bullish flag breakout

candlesticks.

Image point number – 4, After hit BUY STOP order you have to place

STOP LOSS two to five pips below of bullish flag breakout candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level bullish flag profit target or near swing high or 1: 2

more risk-reward ratio as per their choice.

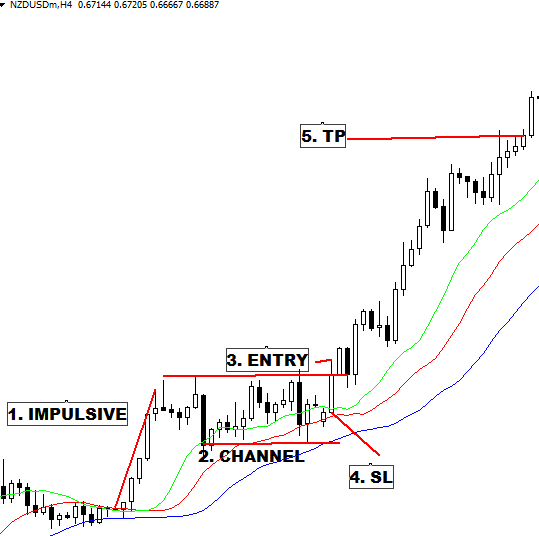

Alligator Indicator with Bullish Channel Pattern Entry-Exit

Strategy:

What is Channel Pattern:

It is actually a continuation pattern. Generally, Channel Pattern finds out in chart

after massive or big bullish or bearish movement. Research has shown that

Channel Pattern is one of the most reliable continuation patterns. Of course,

trend lines run parallel. Supply, demand seems balanced at the moment. Thus

buyers and sellers seem equal.

Above the image of Channel Pattern, we found below things.

Bullish channels create parallel tops and parallel bottoms. This pattern

goes against the uptrend but the channel goes ahead with parallel.

Bearish channels create parallel tops and parallel bottoms. This pattern

goes against downtrend but the channel goes ahead with parallel.

Minimum two parallel tops and two parallel bottoms required for bullish

channel pattern.

Minimum two parallel tops and two parallel bottoms are required for a bearish

channel pattern.

Image point number – 1, Candlesticks close above alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be a long or short opportunity.

Image point number- 2, After impulsive mode price creates a top. Sellers

try to be powerful here.

Hmm… Sellers are powerful here thus prices are in the corrective mode now.

Also, create the bottom. But it’s time to wait and observe.

After corrective mode buyers are trying to strong here. Also, create

another top that is not high from the previous top. Wait for reversal

candlesticks pattern.

Hmm… again sellers are powerful here thus prices are in the corrective mode

now. Also, create another bottom that is low than the previous bottom. But

it’s time to wait and observe.

After impulsive mode price creates a bullish channel pattern. Wait for

bullish channel pattern breakout.

Image point number –3, Conservative or Aggressive trader put their

BUY STOP order two to five pips above the bullish channel breakout

candlesticks.

Image point number – 4, After hit BUY STOP order you have to place

STOP LOSS two to five pips below of bullish channel breakout

candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level bullish channel profit target or near swing high or

1: 2 more risk-reward ratios as per their choice.

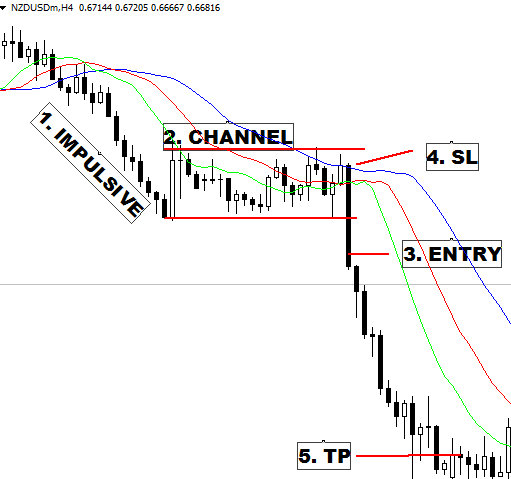

Alligator Indicator with Bearish Channel Pattern Entry-Exit

Strategy:

Image point number – 1, Candlesticks close below alligator indicator.

And the movement is full of impulsive. You have to watch the market.

Anything can happen here. It will be a long or short opportunity.

Image point number- 2, After impulsive mode price creates the bottom.

Buyers try to be powerful here.

Hmm… Buyers are powerful here thus prices are in the corrective mode now.

Also, create a top. But it’s time to wait and observe.

After corrective mode sellers are trying to strong here. Also, create

another bottom that is not the low of the previous low. Wait for reversal

candlesticks pattern.

Hmm… again buyers are powerful here thus prices are corrective mode

now. Also, create another bottom that is high of the previous high. But it’s

time to wait and observe.

After impulsive mode price creates a bearish channel pattern. Wait for

a bearish channel pattern breakdown.

Image point number –3, Conservative or Aggressive trader put their

SELL STOP order two to five pips below of the bearish channel

breakdown candlesticks.

Image point number – 4, After hit SELL STOP order you have to place

STOP LOSS two to five pips above bearish channel breakdown

candlesticks.

Image point number – 5, Conservative or aggressive traders place

their take profit level bearish channel profit target or near swing low or

1: 2 more risk-reward ratios as per their choice.

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience