WHAT IS A BREAKOUT TRADE?

The breakout strategy involves two phases. The first phase involves waiting

for the market to consolidate. A consolidated market becomes very choppy

and directionless, the trader waits and watches the market. The breakout

trader is a patient trader. This strategy is largely based on patience and

timing.

Perhaps you have traded a version of the breakout trade in the past.

There are many versions of this trading set-up, so you might know the drill:

You wait and watch the market when it is calm. You are waiting when

the market is trading within a tight range. Then, eventually, the market

breaks out and extends beyond the restricted range and rockets off in one

direction for a strong, sustained trending move. This is where the well-placed entry will capture a quick profit at the very least, and may even

afford an early entry into a strong, sustained trend.

Identifying the Transition

As a flight merchant, you are taking advantage of the natural rhythm of the market and, specifically,

the transition between the boring, restricted movement of the range-bound market and

the fierce strong moves of the trending

market. When will you know that the market is changing? How do you determine

that the consolidation period is over? Will the market offer a clue

when it’s close to getting in a trending phase?

Is it possible to determine when the market ends the directionless

phase and begins the strong trending phase? The answer is yes, and you

will use your old flame, the support, and the resistance zone. The support and

resistance zone are going to be on the brink by that you choose the movement

of the market once again. This time the support and resistance zone will

mark the road within the sand for the naked version of the flight trade—the

last-kiss trade.

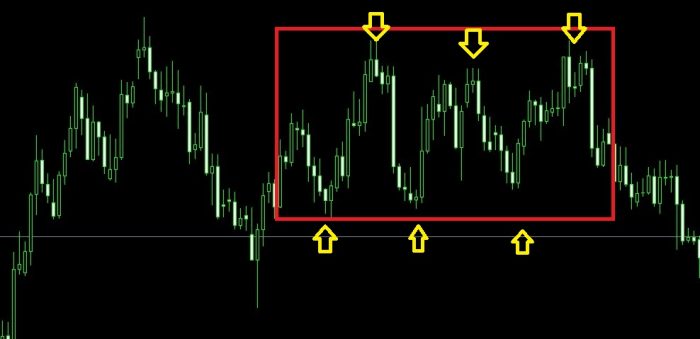

The first step of the last-kiss trade is to spot the consolidation zone.

One way to visualize a consolidation zone is to draw a box on the chart.

This box will contain the choppy movements of the directionless market.

This box should encompass the market movement during the choppy,

drifting-market phase (see Figure 0.1).

The important thing to remember here is that the box, which contains

the market activity, is formed by both a support zone and a resistance zone.

This box of market activity should pop out on the chart—it should be obvious

that the market is stuck between both of the zones. Typically, there

will be several touches on either side of the zones. In Figure 0.2 we see that

there are three touches at the top of the box (market found resistance) and

two touches at the bottom of the box (market found support).

The consolidation part within the box could continue for a few times.

However, once the market breaks out toward either the support zone or

the resistance zone, the last-kiss trader takes notice. For many breakout

traders, the move outside of the consolidation box can trigger a trade. However,

the last kiss trade isn’t triggered at this stage.

A close examination of a typical, standard breakout trade may be in

order. The typical breakout strategy will follow a series of events. First, the

market consolidates, and a box is drawn around the consolidation. Second,

the market pushes beyond either the support zone or the resistance zone

to trigger a trade

(see Figure 0.3).

This move beyond the zone is the trade signal. In fact, standard breakout traders often

place buy stop orders above the resistance zone and sell

FIGURE 0.1 This box on the USD/CAD four-hour chart may be used to contain the

price action in the market during the drifting-market phase.

stop orders below the support zone in anticipation of the prison-breaking. There

are, of course, varying degrees of variations among prison-breaking strategies;

however, the core principle that guides prison-breaking methods is this: Once

the market breaks out on the far side of a zone, a trade is triggered.

However, the quality prison-breaking methods have an awfully common drawback.

Many prison-breaking trades find yourself as losing trades as a result of they’re triggered by a fake-out. what’s a fake-out, you ask?

The Fake-Out

The fake-out is the breakout trader’s nemesis. This is the biggest problem

with most breakout trading strategies. Many breakout signals offer excellent trading opportunities, but others are triggered by fake-outs. A fake-out

FIGURE 0.2 The consolidation zone should be very obvious. Notice how the market bounces off of the support zone and the resistance zone several times on the

four-hour USD/CAD chart. Twice the market finds support at the bottom of the box

and three times the market finds resistance at the top of the box.

is a move outside of the consolidation zone that appears to be a breakout,

but instead of continuing on in one direction a strong trend, the market

retraces back inside of the consolidation zone. The fake-out always ends

up with the market eventually falling back inside the zone defined by both

the support and the resistance levels (back inside the box). The USD/CAD

four-hour chart in Figure 0.4 is an example of a fake-out. The strong move

outside the box (see arrow) is assumed to be a breakout, but the market

retraces and eventually falls back inside the box.

Thus, a fake-out is a breakout trade that is triggered by a convincing

candlestick that extends beyond a support or resistance zone. This action

is followed by the market moving back inside the consolidation box (see

FIGURE 0.3 This four-hour chart on the USD/CAD shows a standard breakout

trade. The trade is triggered once the market moves beyond either the support zone

or the resistance zone. In this example, the market breaks out to the upside, signaling

a buy trade.

(Figure 0.5).

Once the market retreats back into the consolidation box after

a fake-out, the value can usually languish within the box for a few times.

The fake-out is actually quite common, and a quick look at the charts

will show how often they do occur.

These failed breakouts, the fake-outs, are the primary reason traders

find it tough to systematically apply break commerce systems. Breakout

systems are simply wrong too often. Breakout systems may occasionally

grab an excellent trend early, but fake-outs signal many losing trades. Why is

this the case? Why are fake-outs so common?

Ask any trading guru the question “how often does the market trend?”

and, depending on the guru, you will be told that the market trends about 15

FIGURE 0.4 This fake-out is marked with the arrow on the USD/CAD four-hour

chart. The market trades higher than the top of the box, but later quickly falls back

inside of the box. For most standard breakout systems this would be a losing trade.

to 30 percent of the time. This is exactly why typical brake systems usually fail. Most of the time, the markets are not ready to start trending;

they spend the majority of the time drifting without direction. This is why

breakout traders often fail.

Would it be nice if you could tell when a breakout is going to continue

onward beyond the consolidation box? What if there was a way to avoid

the dreaded fake-out? Would you like a trading system for identifying the

breakouts most likely to continue onward in the direction of the trend?

There is such a system, and it is called the last-kiss trade. The last kiss is a

specific kind of break that implies a break can grow to be a robust

trending move.

FIGURE 0.5 Another fake-out, this time on the USD/CAD daily chart. The market

trades beyond the bottom of the box, triggering a sell trade, but then the market

quickly jumps back up inside the consolidation box. This would be a failed breakout

trade for most breakout trading systems.

more system Click here

Earn Money Forex Best Forex Trading Experience

Earn Money Forex Best Forex Trading Experience